Analysts See Strong Upside Potential for Key ETFs

In our analysis of ETFs at ETF Channel, we evaluated the trading prices of holdings against the average 12-month forward target prices set by analysts. We’ve computed the weighted average implied target price for the Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF (Symbol: GSLC). The findings reveal an implied target price of $129.11 per unit for the ETF.

Currently, GSLC is trading at approximately $111.62 per unit, indicative of a 15.67% potential upside based on the average analyst targets for its underlying holdings. Notably, three of these holdings—Live Nation Entertainment Inc (Symbol: LYV), PG&E Corp (Symbol: PCG), and NextEra Energy Inc (Symbol: NEE)—show significant upside compared to their analyst targets.

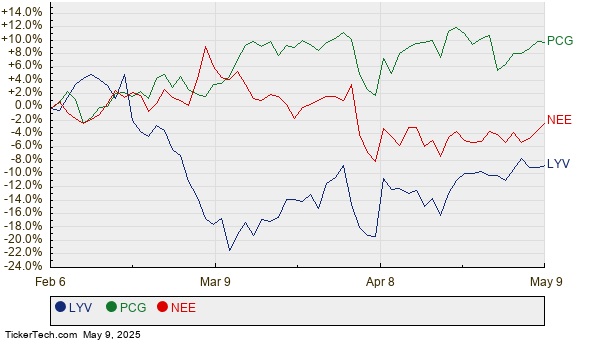

For instance, LYV, trading at $134.69 per share, has an average analyst target of $166.00, suggesting a 23.25% upside. PCG, at a recent price of $17.18, has a target of $21.07 per share, reflecting a potential upside of 22.62%. Meanwhile, analysts expect NEE to reach a target price of $81.74, which is 19.64% above its current trading price of $68.32. Below is a twelve-month price history chart comparing the performance of LYV, PCG, and NEE:

Here’s a summary table of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF | GSLC | $111.62 | $129.11 | 15.67% |

| Live Nation Entertainment Inc | LYV | $134.69 | $166.00 | 23.25% |

| PG&E Corp | PCG | $17.18 | $21.07 | 22.62% |

| NextEra Energy Inc | NEE | $68.32 | $81.74 | 19.64% |

Consider whether analysts are justified in their targets, or if they might be overly optimistic about future stock performance. Evaluating the rationale behind these targets is crucial, as high price targets compared to current trading prices could indicate optimism. However, they could also foreshadow future downgrades if reflected by outdated perspectives. Investors should conduct thorough research to assess the validity of these projections.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Insights:

• Waste Management Dividend Stocks

• VSTS Historical Stock Prices

• Funds Holding EDIT

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.