Rivian Automotive, Inc. (RIVN) is focusing on its upcoming R2 and R3 models designed specifically for the European market, as stated in their third-quarter 2025 earnings transcript. Although a launch schedule has yet to be confirmed, Rivian’s choice of a new manufacturing plant in Georgia is strategic for efficient export access to Europe. This decision comes in a favorable market climate, with the U.S. dollar weakening and European import duties on U.S.-built vehicles being eliminated from 10% to 0%.

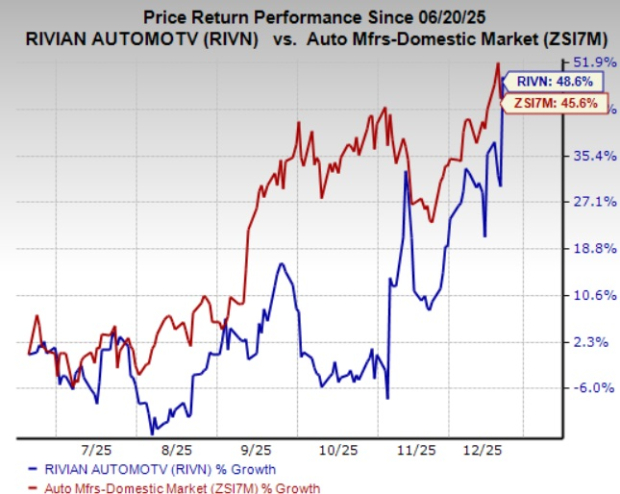

At present, Rivian is prioritizing domestic demand before determining European rollout dates. The company saw RIVN shares increase by 48.6% over the past six months, outperforming its sector, while competitors Lucid Group, Inc. (LCID) and Ford Motor Company (F) gained 45.6% and 25.8%, respectively. Rivian continues to navigate a challenging valuation landscape, trading at a forward price/sales ratio of 3.74, higher than the industry average of 3.48.