Meta Platforms: A Strong Start to 2024 with Promising Trends Ahead

Shares of Meta Platforms (NASDAQ: META) saw significant gains last month. The social media giant experienced a surge in its stock price driven by a potential TikTok ban, enhanced ties with President Donald Trump, increased investment in artificial intelligence (AI), and revelations about DeepSeek technology.

Earnings Report Sparks Stock Surge

Toward the end of January, the stock soared following the release of its fourth-quarter earnings report, which exceeded analysts’ expectations.

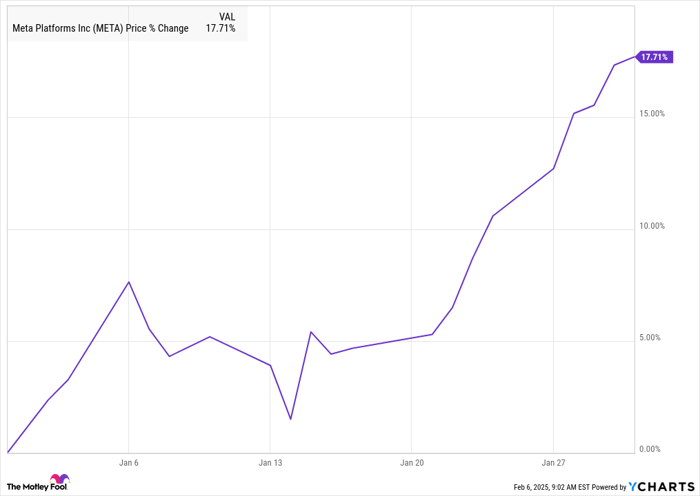

Data from S&P Global Market Intelligence indicates that Meta’s stock climbed 18% by the end of the month. The ensuing chart illustrates the stock’s remarkable growth after the inauguration.

META data by YCharts

Building Momentum

Meta concluded an impressive 2024 with notable stock performance and robust quarterly results, propelled by its highly regarded AI assistant, Meta AI.

With a favorable outlook in January, many investors anticipate continued momentum for the tech giant, capitalizing on several beneficial industry trends.

Initially suspended, the TikTok ban by President Trump created negative publicity that could inadvertently favor Meta. An eventual sale of TikTok to an American company might also weaken its algorithm, benefiting Meta’s platforms like Facebook and Instagram.

Following the inauguration, stocks generally rose. Investors are optimistic that Meta will thrive in a more business-friendly environment, which could lead to tax cuts and other advantages.

Despite a tough week for AI stocks after the DeepSeek launch, Meta distinguished itself as a standout performer since its open-source model resonated well with investors. Unlike companies heavily invested in cloud services, Meta is positioned to harness advancements in AI while integrating them across its social media and hardware offerings. The stock edged up by 2% on January 27, even as Nvidia faced considerable losses.

Meta’s impressive earnings report ended the month on a high note, revealing an astounding 50% rise in earnings per share, reaching $8.02.

Image source: Getty Images.

Looking Ahead for Meta

In the earnings call, CEO Mark Zuckerberg expressed optimism about Meta AI, predicting it will reach over 1 billion users by the year’s end. The company is also making strides in other areas, including its Ray-Ban smart glasses, which saw over 1 million units sold in 2024.

While first-quarter forecasts suggest a revenue growth slowdown to between 8% and 15%, Meta’s positioning as a leader in AI and its expanding user and advertising base provide a solid foundation for another successful year. Despite the recent gains, the stock continues to appear attractive for potential investors.

A Call to Investors

Wondering if you’ve overlooked investing in top-performing stocks? You may want to take notice now.

Occasionally, our team of experts releases a “Double Down” stock recommendation, signaling companies poised for significant growth. If you’re concerned about missing out, this could be the perfect opportunity to act. The facts are compelling:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d now have $323,686!

- Apple: A $1,000 investment when we doubled down in 2008 would yield $44,026.

- Netflix: Investing $1,000 in 2004 would have turned into $545,283.

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and this may be a rare chance to join in.

Learn more »

*Stock Advisor returns as of February 3, 2025

Randi Zuckerberg, a former marketing director for Facebook and sister to CEO Mark Zuckerberg, serves on The Motley Fool’s board. Jeremy Bowman is invested in Meta Platforms and Nvidia. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.