AMD Stock Surges as New $10 Billion Saudi Deal Boosts Outlook

Advanced Micro Devices (NASDAQ:AMD) saw a notable increase of over 4% during Tuesday’s trading session, marking a nearly 20% rise over the past month. What factors are driving this upward trend in AMD’s stock price?

AMD’s $10 Billion Saudi Contract

On Tuesday, AMD revealed a $10 billion partnership with Humain, a startup based in Saudi Arabia and supported by the Saudi sovereign fund. Humain plans to purchase CPUs, GPUs, and software from AMD to develop data centers and AI infrastructure. By 2030, Humain is projected to establish data centers with a power capacity of approximately 1.9 gigawatts. Importantly, Humain aims to diversify its hardware sources for AI, allowing it not to rely on a single vendor. This diversification strategy opens up opportunities for AMD, especially as companies seek alternatives to Nvidia in the rapidly expanding AI sector. Additionally, state-sponsored AI initiatives are becoming more attractive for semiconductor firms like AMD, which look to broaden their customer base beyond major tech companies such as Amazon, Google, and Microsoft.

Strong Q1 Earnings Report

AMD’s Q1 earnings report exceeded expectations, with a favorable outlook for Q2 as well. Revenue grew by 36% to $7.44 billion in Q1, and earnings per share reached $0.96. This growth was largely fueled by a 57% increase in data center sales, totaling $3.7 billion, driven by higher shipments of GPUs and CPUs. AMD has continued to capture market share from Intel in the data center segment. While AMD’s GPU offerings do not yet rival Nvidia’s at the high end, the ongoing AI boom is benefiting the overall market. New large-scale AI models, such as OpenAI’s GPT-4o and China’s DeepSeek R1, are expected to drive further demand for GPUs. With new GPU and AI data center contracts, AMD is well-positioned in a dynamically changing landscape.

Potential Easing of China Restrictions

This month, AMD indicated that the recent U.S. export restrictions on its MI308 AI chips could lead to a $1.5 billion revenue decline by 2025. The company also noted it might incur up to $800 million in charges related to inventory and contractual commitments due to these restrictions. Under the new guidelines, AMD must secure a license to export advanced AI processors to China, which is significant since China accounts for roughly 24% of its revenue. However, there are signs of easing U.S.-China trade tensions, with both nations suspending extensive tariffs for 90 days and showing progress in negotiations over the weekend. This optimism raises the possibility that some chip export restrictions could soon be relaxed.

Volatility in AMD’s Stock Performance

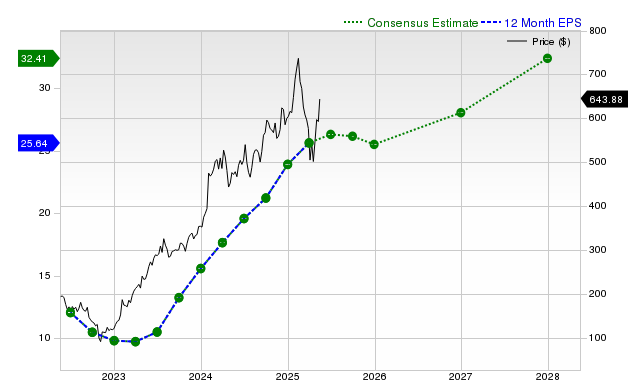

Over the past four years, AMD’s stock performance has shown considerable volatility compared to the S&P 500. Returns have swung dramatically, with 57% in 2021, -55% in 2022, 128% in 2023, and -18% in 2024. The Trefis High Quality (HQ) Portfolio, consisting of 30 stocks, has displayed much less volatility and has outperformed the S&P 500 over the same period. This portfolio achieved better returns with lower risk, resulting in a steadier performance. Given the current uncertain macroeconomic landscape surrounding interest rates and global conflicts, questions arise as to whether AMD may encounter challenges similar to those of 2022 and 2024 or if it will experience significant gains in the year ahead.

Currently, we value AMD stock at approximately $107 per share, aligning closely with its existing market price. For further insights, refer to our analysis on AMD Valuation: Is AMD Stock Expensive Or Cheap? for a detailed comparison with industry peers.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.