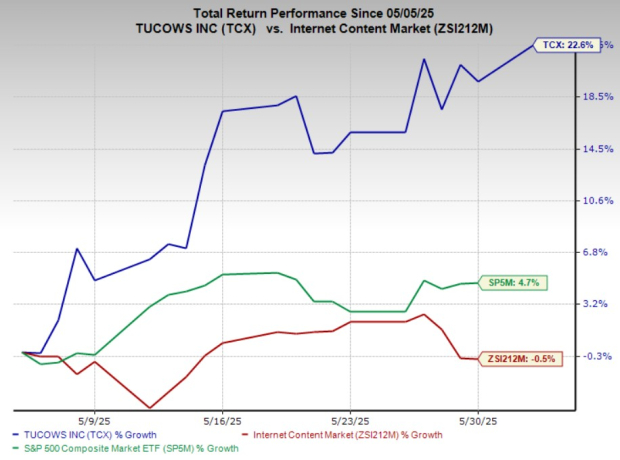

Tucows Inc. Surges 22.6% in Stock Value Over Last Month

Tucows Inc. (TCX) saw its stock rise by 22.6% in the past month, contrasting with a 0.5% decline in the industry composite stocks. This performance also surpasses the S&P 500’s growth of 4.7% during the same timeframe.

Image Source: Zacks Investment Research

Strong First Quarter Results Enhance Investor Confidence

For the first quarter of 2025, Tucows reported revenues of $94.6 million, an 8% increase from the previous year. Gross profit rose 29% to $23.5 million, while adjusted EBITDA increased 225% to $13.7 million. Although the net loss stood at $15.1 million, it reflected notable improvement compared to the prior year. Each core unit—Ting, Wavelo, and Tucows Domains—contributed positively, helped by cost efficiency and product innovations.

Cost Structure Adjustments Improve Profitability

In the past year, Tucows implemented strategic cost-cutting measures and restructured its Ting operations to focus on partnerships rather than direct builds. These changes have led to improved margins and earnings quality.

Ting’s Shift to Partnerships Increases Efficiency

By pivoting to a partner-driven model, Ting has minimized capital expenditures while enhancing operational efficiency. This new approach allows for better capital preservation as interest rates remain high, proving increasingly valuable in today’s market.

Wavelo Establishes Itself as a High-Margin Growth Segment

Tucows’ software platform, Wavelo, is securing its place with large global telecom providers. By offering billing and provisioning solutions, it is becoming integral to the modernization of these operators. Strong early growth is evident in Latin America and Europe.

Tucows Domains Continues to Provide Stable Profitability

The mature sector of Tucows Domains remains resilient, achieving margin growth and consistent transaction volumes despite competitive pressures. Progress with India’s .in ccTLD and the upcoming 2026 gTLD application round offer additional opportunities for revenue growth.

Consistent Revenue Streams Reduce Volatility

Tucows enjoys lower volatility than its industry peers due to stable revenue from domain registrations and conservative management. Its beta of 0.83 indicates it is less volatile than the overall market, contributing to consistent performance.

Positioned for Growth in Expanding Markets

The fiber internet and telecom software sectors are expected to grow by 12-15% annually through 2030. Tucows’ strategic realignments across its business units align well with this expected growth trend.

Fundamental Strength Drives Stock Performance

Tucows’ recent stock increase is underpinned by genuine operational improvements. The company has enhanced its balance sheet and growth strategy, making it a significant player in the digital infrastructure space.