Tesla Stock Faces Significant Pullback Amid Market Challenges

Following a strong rally after the election, Tesla (NASDAQ: TSLA) has encountered serious setbacks in February. A confluence of factors, including macroeconomic challenges and CEO Elon Musk’s role in the Department of Government Efficiency (DOGE) initiative, contributed to a notable decline in the stock.

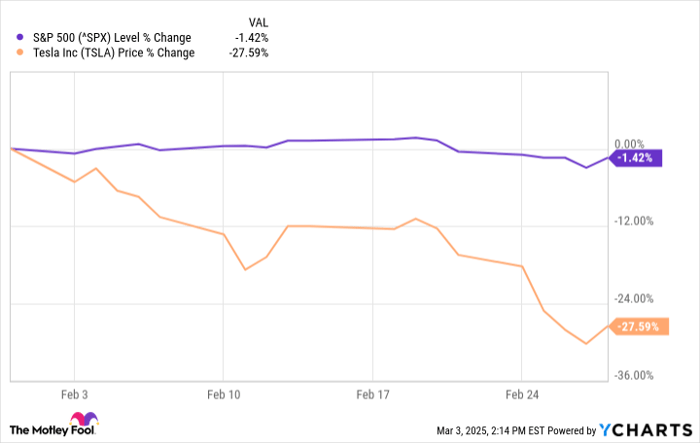

By the end of February, the stock had plummeted 28%, as reported by S&P Global Market Intelligence.

As illustrated in the chart below, the stock trended downward throughout most of the month.

^SPX data by YCharts

The End of the Tesla-Trump Trade

Initially, Tesla stock gained traction following the election, driven by investor optimism surrounding Musk’s connection with Donald Trump. However, this sentiment faltered last month as it became apparent that Trump’s influence on Tesla’s fortunes is limited. Moreover, Musk’s political engagements seem to alienate some potential customers, particularly due to his actions related to government layoffs, his support for a far-right party in Germany, and other controversial initiatives.

Multiple factors contributed to the decline of Tesla stock last month. Many investors grew cautious, believing the stock was overvalued after a significant price surge that had little backing from fundamental changes in the business. Concerns arose that Musk’s political distractions were affecting his leadership, and the stock faced additional pressure following his involvement in a $97.4 billion bid for OpenAI.

Furthermore, tariffs are expected to impact Tesla, similar to effects felt across the auto sector. Pressure on China could also adversely affect a critical market for the company.

Recent data from Europe shows a decline in Tesla registrations by 45% year-over-year in January, despite overall electric vehicle sales rising by 37%. While this statistic represents just one month and may reflect temporary supply chain or market fluctuations, persistent trends could significantly harm Tesla’s performance. Anecdotal reports also suggest declining sales in California, where anti-DOGE protests have occurred at Tesla stores.

A Tesla Cybertruck. Image source: Tesla.

Implications for Tesla’s Future

The extent of reputational damage resulting from Musk’s political involvement is difficult to ascertain; however, it is evidently a concern. Stronger fundamentals might suggest a more stable price floor for Tesla stock. Nevertheless, the company reported a decline in vehicle sales last year, and with the stock trading at a price-to-earnings ratio above 100, significant additional declines could still occur. While investors remain hopeful that advancements in AI and robotaxis will drive future growth, maintaining a solid consumer reputation is crucial, an area that Musk may jeopardize.

Don’t Miss This Potentially Lucrative Opportunity

Have you ever felt like you missed an opportunity to invest in successful stocks? If so, listen closely.

Occasionally, our expert analyst team issues a “Double Down” stock recommendation for companies they identify as poised for significant growth. If you fear you’ve missed your chance to buy, now may be the appropriate time to act. The numbers reflect promising potential:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $323,920!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $45,851!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $528,808!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, which may not have another chance like this soon.

Continue »

*Stock Advisor returns as of March 3, 2025

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.