Market Analysis: Understanding Fear and Opportunity Amid Trade Wars

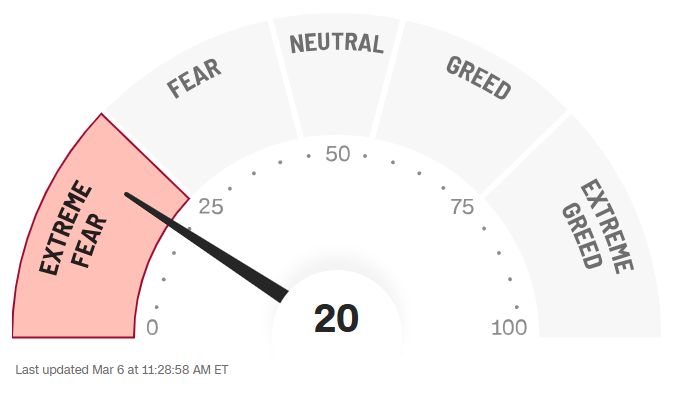

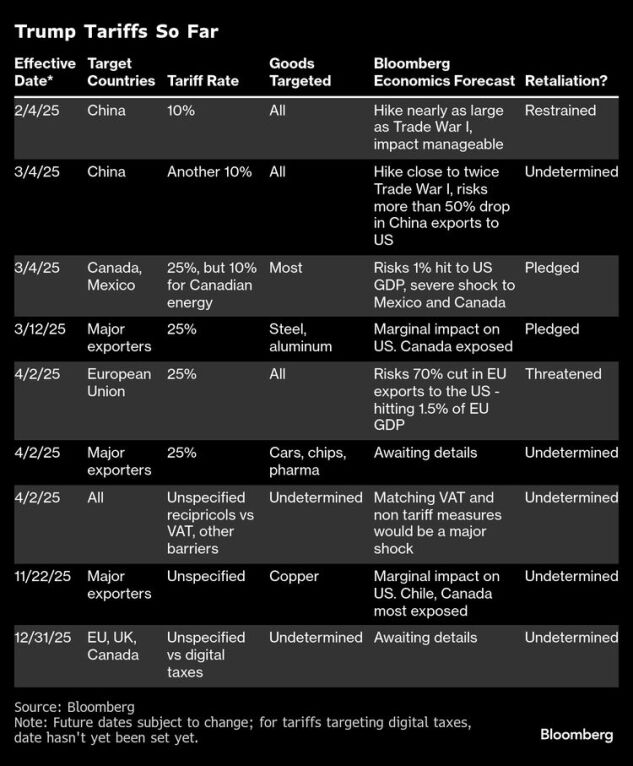

Wall Street icon Warren Buffett famously advises investors to be greedy when others are fearful. Currently, fear is pervasive. Factors contributing to this anxiety include the onset of a global trade war, rising government layoffs, slowing job growth, weakening economic conditions, plummeting consumer and business sentiment, and significant stock market declines.

Source: CNN

So, does the current climate warrant a greedy approach to investing? I think so.

Before diving in, let’s examine the prevalent fears and underlying conditions that are fostering a bearish sentiment, alongside the potential for optimism moving forward.

Market Risks and Economic Implications

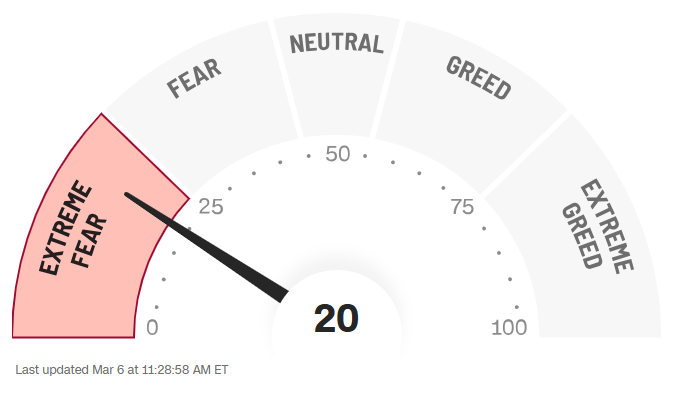

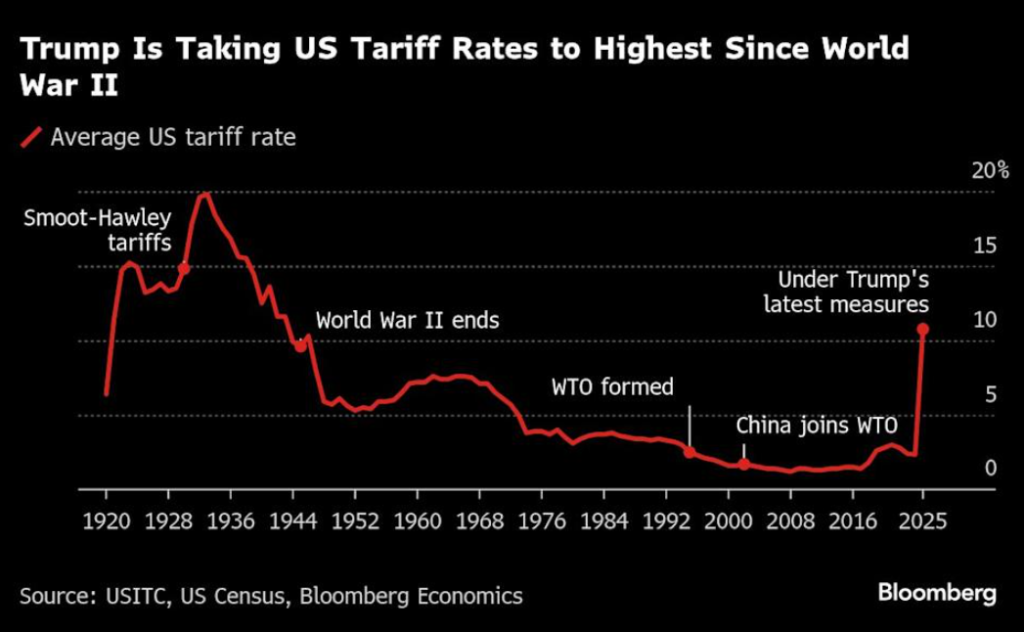

This week, President Donald Trump initiated what could be the most extensive trade war in a century. He imposed a 25% tariff on goods from Canada and Mexico, alongside an additional 10% tariff on goods from China. With these actions, the average U.S. tariff rate has surged from 2.3% to 11.5%, marking the highest rate since World War II.

Experts predict significant adverse effects on the economy resulting from these tariffs. U.S. companies are likely to face increased import costs, leading them to choose between absorbing the costs (which would reduce profit margins), passing them onto consumers (resulting in inflation), or reorganizing supply chains which could disrupt operations.

Regardless of the chosen strategy, economic growth is expected to be negatively impacted. Federal Reserve researchers estimate that increasing the average U.S. tariff rate to 11.5% could reduce GDP growth by 1.3%.

Current growth estimates indicate the U.S. economy is already performing poorly this quarter. The Atlanta Fed projects a -2.8% growth rate even before the tariffs were imposed. A further decline of 1.3% could push U.S. GDP growth below -4%, an alarming prospect that does not even factor in forthcoming tariffs.

Stock Market Reactions to Tariff Announcements

Trump has made it clear that he intends to impose tariffs on aluminum, steel, copper, lumber, pharmaceuticals, and other goods in the coming month. He also plans to establish reciprocal tariffs by April.

This ongoing economic landscape poses considerable risks but may also present unique investment opportunities for those willing to navigate the treacherous waters of market volatility.

Investors Remain Cautious as Tariff Concerns Loom

If a significant portion of proposed tariffs is enacted, the average U.S. tariff rate could soar to between 15% and 20% by summer. This potential increase may result in a 1% to 2% decrease in GDP, potentially lowering GDP to below -5%. Such a scenario could mirror the economic hardships experienced during the Covid era and the Great Financial Crisis.

Given these circumstances, it is understandable that investors are feeling nervous.

However, we believe that investors should consider being opportunistic, as the worst-case scenario is unlikely to unfold.

In our assessment, it appears that former President Trump is leveraging tariffs primarily as a negotiating tactic to secure better deals for the U.S., suggesting that this trade war is unlikely to be prolonged.

To illustrate this, consider the following historical actions:

- In early February, within 24 hours of announcing extensive tariffs on Canada and Mexico, all three nations struck an agreement to delay their implementation.

- Less than a day after Trump suspended military aid to Ukraine, reports surfaced that an agreement was reached on a minerals deal, allowing aid to resume.

- Upon Trump enacting sweeping tariffs against Canada and Mexico, reports emerged of efforts to negotiate a deal to eliminate some or all of these duties.

- Additionally, just a day later, Trump postponed the imposition of auto tariffs on Canada and Mexico for a month.

Issue the threat. Push the opposing party to negotiate. Strike a deal. Withdraw the risks.

If this pattern continues, concerns about a global trade war causing a U.S. recession may be exaggerated. Consequently, recent stock market declines could also be overblown.

Is now the right time to buy stocks?

We believe it is.

Indicators Suggest a Market Bottom

Consider this perspective: Amid fears stemming from the trade war, both the S&P 500 and the Nasdaq have recently declined to around their 200-day moving averages—an important technical support level historically known as the market’s “last line of defense.” Currently, the S&P is slightly above this level, while the Nasdaq previously dipped below, only to recover quickly.

These indices have approached their 200-day moving averages only twice in the past two years: in March and October of 2023. In both instances, stocks found a bottom and rallied significantly over the subsequent months.

From March 2023 to July 2023, the S&P experienced a 20% increase, while the Nasdaq climbed nearly 30%. Following the late 2023 dip, the S&P surged about 40% from October to July 2024, and the Nasdaq jumped nearly 50%.

In essence, the last two occurrences of the S&P 500 and Nasdaq flirting with their 200-day moving averages were followed by impressive recoveries.

Now, we find ourselves in a similar situation once again.

This time may be different, or it could represent an excellent opportunity to invest in stocks ahead of a prospective rally.

Key Takeaways on Stock Investments

While there are valid reasons this stock selloff may diverge from past patterns, the evidence suggests it likely does not.

Current price movements indicate another pullback in the context of a broader market uptrend. If that’s the case, stocks may be at or near their bottom, setting the stage for significant gains heading into summer.

Is it time to make investments? We believe so.

This brings us to an informational presentation centered on the key figure influencing this selloff—Donald J. Trump.

It is evident that Trump’s policies will have a substantial and multifaceted impact on the economy and the markets. To prepare adequately for the next four years, stakeholders must understand these potential influences, what stocks to consider buying in a ‘Trump 2.0’ scenario, and which ones to steer clear of.

All of this is detailed in my recent briefing.

Click here to explore it further.

On the date of publication, Luke Lango did not hold (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. To stay updated on the latest market analysis by Luke, check out our Daily Notes! Explore the latest issues on our Innovation Investor and Early Stage Investor subscriber sites.