Key Points

-

Oracle’s credit default swap pricing indicates bond market skepticism regarding its financial stability.

-

Oracle (NYSE: ORCL) and Microsoft face higher risks due to exposure to OpenAI, while Alphabet (NASDAQ: GOOGL) is less affected.

-

Market discernment could improve risk management in AI investments.

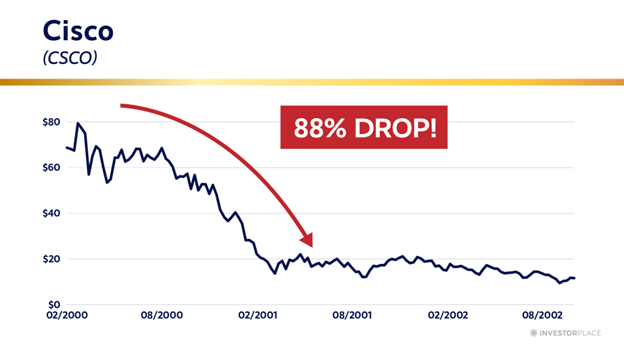

Oracle’s credit default swap (CDS) pricing has risen significantly, indicating increasing market concern about the company’s future, nearly quadrupling since September to elevated levels as of November. This reaction is largely attributed to Oracle’s $300 billion deal with OpenAI, which is projected to incur over $100 billion in cash burn before generating positive cash flow by 2030.

While Oracle and Microsoft are struggling due to exposure to OpenAI—45% of Microsoft’s backlog is tied to this partnership—Alphabet showcases resilience with minimal exposure and a stronger financial footing to support AI investments. The shifting perspectives in both bond and equity markets may lead to more realistic pricing and sustainable growth in AI technology.