“`html

Brown & Brown, Inc. (BRO) reported a 14.5% year-over-year revenue increase to $182 million for the second quarter of 2025, with organic growth at 3.9%. The EBITDAC rose 17% to $62 million, marking a margin expansion to 34.1%. The company’s management forecasts an 8.4% organic growth rate for 2025, underlining the importance of Wholesale Brokerage as a driver of profitability.

The Wholesale Brokerage segment plays a critical role in BRO’s strategy by delivering recurring revenue through commissions while capitalizing on market conditions characterized by higher pricing since the hard market cycle began in 2018. The insurance industry’s resilience is supported by solid retention and net new business growth.

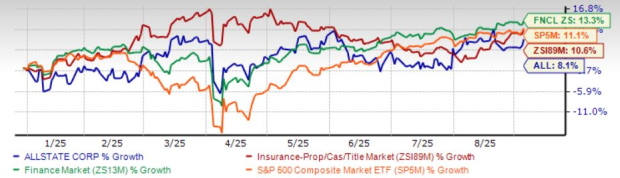

Currently, BRO shares have decreased by 6.4% year-to-date, compared to the industry’s decline of 14.2%. The Zacks Consensus Estimate predicts a 7.6% year-over-year earnings growth for 2025, followed by a 16.5% increase in the subsequent year.

“`