Investors know that comfort can be deceptive in the financial world. Just when things appear stable, an innovation can disrupt the landscape. The late 2022 launch of ChatGPT showcased artificial intelligence (AI) and ignited competition in a multi-trillion-dollar industry. Now, a breakthrough from a Chinese firm called DeepSeek might be stirring things up once again.

Here’s what you need to know about this developing story.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Understanding DeepSeek

DeepSeek is a Chinese tech company that developed DeepSeek-R1 to rival ChatGPT-4 and other large language models (LLMs) such as Alphabet’s (NASDAQ: GOOG) (NASDAQ: GOOGL) Google Gemini and Llama 3 from Meta Platforms (NASDAQ: META). What makes this noteworthy is that DeepSeek asserts it trained its model with just $6 million and 2,000 somewhat outdated Nvidia (NASDAQ: NVDA) graphics processing units (GPUs). This claim stands out as competitors reportedly spend hundreds of millions on resources and thousands of high-end GPUs—for instance, xAI’s Colossus relies on 200,000 GPUs, targeting a million eventually.

DeepSeek’s announcement negatively affected Nvidia’s stock, which dropped more than 20% from its recent peak as investors worried about the implications for GPU demand.

Yet, is DeepSeek’s achievement what it appears to be? Some industry experts suggest that the company’s actual investment might be around $1.6 billion, with a total of 50,000 Nvidia GPUs at their disposal. It is possible that DeepSeek may have overstated its success due to U.S. regulations on high-powered GPUs, perhaps trying to deflect attention from regulators or enhance its visibility. Regardless, it seems that major U.S. tech firms will continue to purchase Nvidia GPUs in large quantities.

Both Alphabet and Amazon (NASDAQ: AMZN) recently disclosed ambitious capital expenditure budgets for 2025 during their earnings calls. Amazon invested $26 billion in the last quarter of 2024 and anticipates this level will persist into 2025, while Alphabet spent $14 billion with plans to allocate $75 billion in 2025. A significant portion of this spending will be directed towards data centers, servers, and GPUs.

Is Nvidia Stock Worth Buying Now?

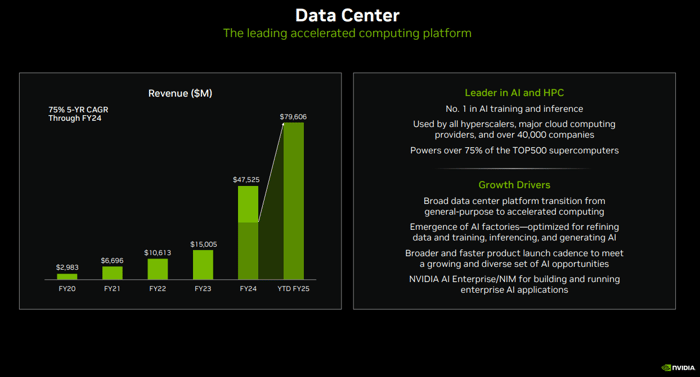

Nvidia’s fiscal 2024 was remarkable, featuring $61 billion in sales, a 126% increase over the previous year, primarily driven by exceptional growth in the data center sector, which generated $48 billion from a 217% rise. Fiscal 2025 is also impressive, with sales hitting $91 billion across the first three quarters, again fueled by data center growth.

Source: Nvidia.

Notably, operating income through the third quarter of fiscal 2025 reached $61 billion, resulting in a 67% operating margin, up from 61% in fiscal 2024. This indicates that demand is increasing as customers are willing to pay premium prices for Nvidia products.

Therefore, the fall in Nvidia’s stock linked to DeepSeek could present an enticing opportunity for long-term investors. The forward price-to-earnings (P/E) ratio has dropped significantly alongside the stock price.

NVDA PE Ratio (Forward) data by YCharts.

The chart illustrates that the sudden dip in valuation isn’t commonplace, happening infrequently. Both of the recent occurrences in 2023 and 2024 turned out to be great buying moments for investors. With doubts surrounding DeepSeek’s claims, major tech companies planning extensive capital investments, and Nvidia’s impressive results coupled with a reduced valuation, long-term investors may want to consider buying the stock at this time.

Where to Invest $1,000 Right Now

When our analyst team shares stock recommendations, it’s worth taking notice. The Stock Advisor program boasts an average return of 932%—far exceeding the S&P 500’s 176%.*

The team has recently identified what they believe are the 10 best stocks for investors to consider today…

Learn more »

*Stock Advisor returns as of February 7, 2025

Randi Zuckerberg, a former director at Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is also on the board. Suzanne Frey, an executive at Alphabet, and Bradley Guichard, who has investments in Amazon, are also members. The Motley Fool has investments in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia. For more details, please view The Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.