Analysts Predict Strong Growth for First Trust BuyWrite Income ETF

Recent evaluations of holdings within ETFs reveal promising upside potential for investors, particularly for the First Trust BuyWrite Income ETF (Symbol: FTHI).

According to our analysis, the implied target price for FTHI, based on underlying holdings, is $26.10 per unit. With the ETF currently trading around $23.69 per unit, the forecast indicates a potential upward movement of 10.17%. Several specific stocks within the ETF are expected to contribute significantly to this growth.

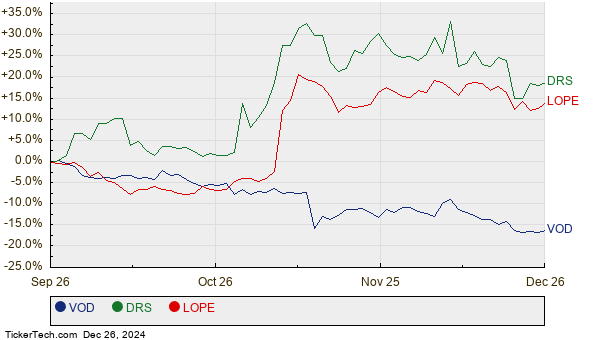

Vodafone Group plc (Symbol: VOD), Leonardo DRS Inc (Symbol: DRS), and Grand Canyon Education Inc (Symbol: LOPE) stand out as key players with notable upside potential. Currently, VOD is trading at $8.43 per share, but analysts have set an average target price of $12.53, reflecting a solid upside of 48.58%. DRS shares are presently priced at $33.02, with a target forecast of $36.67, indicating an 11.04% increase. Lastly, LOPE is trading at $162.94, while the average analyst target is $179.67, representing a potential gain of 10.27%. Below is a twelve month price history chart comparing the stock performance of VOD, DRS, and LOPE:

Here’s a summary of the analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust BuyWrite Income ETF | FTHI | $23.69 | $26.10 | 10.17% |

| Vodafone Group plc | VOD | $8.43 | $12.53 | 48.58% |

| Leonardo DRS Inc | DRS | $33.02 | $36.67 | 11.04% |

| Grand Canyon Education Inc | LOPE | $162.94 | $179.67 | 10.27% |

This raises questions about the validity of these targets. Are analysts justified in their predictions, or are they being overly optimistic? While high target prices can show confidence in a company’s future, they may also lead to downgrades if analysts fail to adjust to changing market conditions. Investors are encouraged to conduct further research to assess the viability of these projections.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Best High Yield Stocks

• BANC YTD Return

• VERU Past Earnings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.