MercadoLibre (MELI) is shifting its strategy to focus on Gross Merchandise Volume (GMV) growth across Latin America by slashing Brazil’s free shipping threshold from R$79 to R$19. This change, implemented in Q3 2025, aims to drive smaller, frequent transactions in a market where e-commerce penetration is currently in the mid-teens. As a result, sold items in Brazil grew by 42% year-over-year, and new listings in the R$19-R$79 segment tripled.

The Zacks Consensus Estimate for MercadoLibre’s fourth-quarter 2025 GMV stands at $19.04 billion, reflecting a 31% year-over-year growth and a sequential rise of 15% from Q3’s $16.5 billion. This indicates a positive outlook as the company prepares for its peak seasonal period. However, MercadoLibre faces execution risks, including compressed contribution margins in Brazil and increasing competitive pressures from Amazon and Sea Limited, which may require ongoing promotional investments to maintain transaction growth.

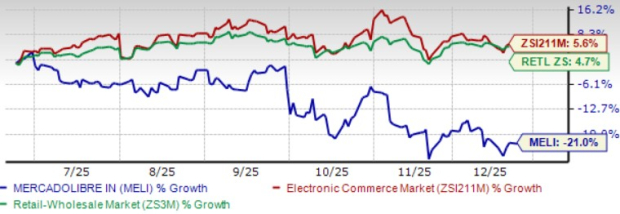

Despite its growth potential, MercadoLibre’s shares have declined 21% over the past six months, underperforming both the Zacks Internet-Commerce industry and Retail-Wholesale sectors. The current forward Price/Sales ratio stands at 2.77X, compared to the industry’s 2.1X, suggesting that while the company is pursuing aggressive growth, it faces challenges in profitability and competition.