Analysts See Strong Upside Potential for Vanguard S&P 500 Value ETF

In our latest analysis of Exchange-Traded Funds (ETFs), we’ve examined the underlying holdings of the Vanguard S&P 500 Value ETF (Symbol: VOOV). By comparing the trading prices of these holdings with the average analyst 12-month forward target prices, we’ve calculated a weighted average implied target price for the ETF itself. Our findings show that the implied analyst target price for VOOV is $204.62 per unit.

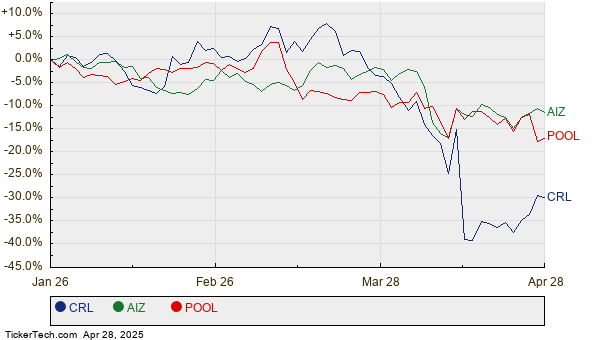

Currently, with VOOV trading at approximately $175.88 per unit, there is an estimated 16.34% upside based on analyst targets for its underlying holdings. Key contributors to this potential upside include Charles River Laboratories International Inc. (Symbol: CRL), Assurant Inc. (Symbol: AIZ), and Pool Corp (Symbol: POOL). CRL’s recent price is $114.66 per share, but analysts estimate an average target of $149.64, indicating a 30.51% upside. AIZ is currently priced at $190.83, with a target of $227.40 set by analysts, reflecting a potential 19.16% increase. Similarly, POOL’s recent trading price of $291.59 is significantly lower than its average target of $344.00, suggesting a 17.97% upside. Below is a chart illustrating the twelve-month price history of CRL, AIZ, and POOL:

Here’s a summary table of the current analyst target prices for the highlighted stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P 500 Value ETF | VOOV | $175.88 | $204.62 | 16.34% |

| Charles River Laboratories International Inc. | CRL | $114.66 | $149.64 | 30.51% |

| Assurant Inc | AIZ | $190.83 | $227.40 | 19.16% |

| Pool Corp | POOL | $291.59 | $344.00 | 17.97% |

Are analysts justified in these upward targets, or could they be overly optimistic regarding these stocks’ performances in the next 12 months? This calls for further investigation by investors. A high price target compared to a stock’s trading price may indicate positive future outlooks. However, it could also suggest the potential for target price downgrades if these targets are based on outdated data.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Explore Further:

• Dividend History

• Funds Holding KARO

• TBA market cap history

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.