Analysts Expect Upside Potential for iShares Dow Jones U.S. ETF

ETF Channel has examined the current trading prices of ETFs in our coverage universe and compared them with the average analyst 12-month forward target prices. For the iShares Dow Jones U.S. ETF (Symbol: IYY), the calculated implied target price from its underlying holdings stands at $161.40 per unit.

Comparing Current Prices and Potential Gains

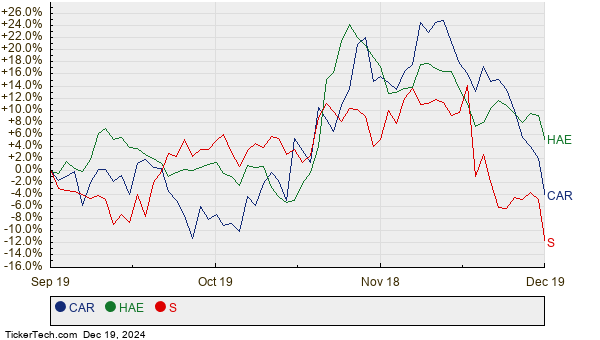

Currently, IYY is trading around $142.78 per unit. This marks a projected upside of 13.04% based on analysts’ targets for the ETF’s underlying assets. Of particular interest are three holdings that show significant potential for growth according to analyst predictions: Avis Budget Group Inc (Symbol: CAR), Haemonetics Corp. (Symbol: HAE), and SentinelOne Inc (Symbol: S). CAR is priced at $83.48 per share, but analysts have set its average target at $120.89, suggesting a 44.81% upside. For HAE, trading at $78.77, the average target price of $109.78 offers a potential increase of 39.36%. Meanwhile, analysts expect S to rise to $30.00 from a recent price of $22.05, which indicates a potential increase of 36.05%. Below is a twelve-month price history chart illustrating the stock performance of CAR, HAE, and S:

A Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Dow Jones U.S. ETF | IYY | $142.78 | $161.40 | 13.04% |

| Avis Budget Group Inc | CAR | $83.48 | $120.89 | 44.81% |

| Haemonetics Corp. | HAE | $78.77 | $109.78 | 39.36% |

| SentinelOne Inc | S | $22.05 | $30.00 | 36.05% |

As we consider these targets, one must ask: Are analysts being realistic, or are they being too optimistic? Investors need to determine whether the analysts have valid reasoning behind their targets or if they are lagging behind recent developments within these companies and their industries. High targets relative to a stock’s current price can indicate strong confidence in the future, but they might also lead to downgrades if they stem from outdated considerations. Thorough research is essential for investors to navigate these complexities.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of CHOC

• CASH YTD Return

• Top Ten Hedge Funds Holding IEIH

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.