The U.S. government has recently engaged in a significant shift from traditional market involvement to direct investment, acquiring equity stakes in four public companies: MP Materials (MP), Intel (INTC), Trilogy Metals (TMQ), and Lithium Americas (LAC). The Pentagon and Department of Energy’s investments have already led to dramatic market reactions, with MP Materials surging 50%, Lithium Americas doubling, and Trilogy Metals tripling in value shortly after the purchases.

This strategic move aims to strengthen America’s supply chains against dependency on China, which controls approximately 99% of the dysprosium supply and nearly 90% of active pharmaceutical ingredients used in drugs. The federal government’s initiative, part of the NDIS Implementation Plan, is expected to focus heavily on securing domestic supply chains across various sectors, including rare earth minerals, semiconductors, and nuclear energy, with a proposed fund of $1.5 trillion aimed at economic mobilization.

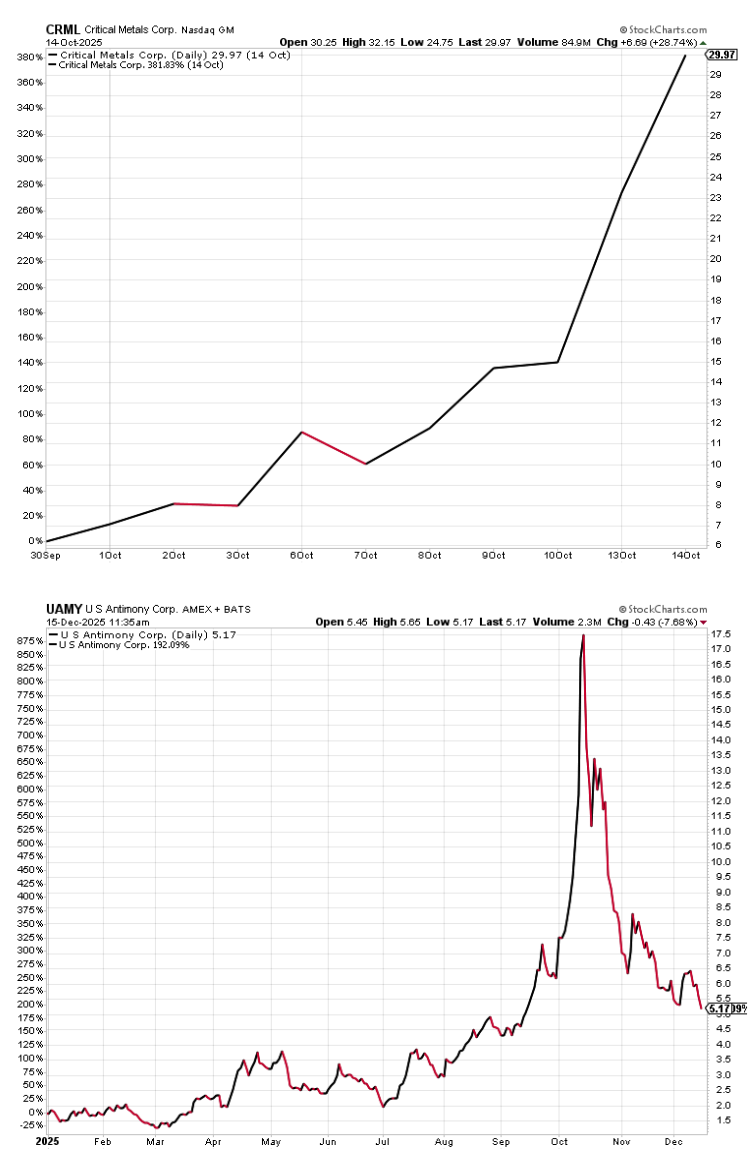

As the government accelerates its buying spree, companies like Critical Metals Corp have already seen stock prices rise by 275% based on rumors of potential funding. With the government prepared to invest heavily in designated strategic sectors, market participants are advised to closely monitor stocks that align with federal purchasing strategies.