“`html

Core News Facts

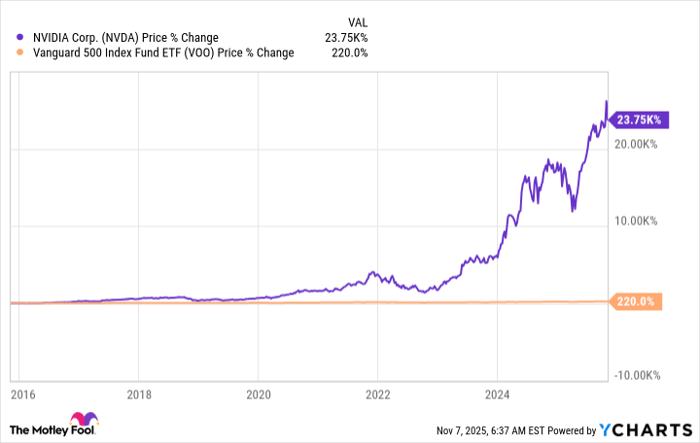

Nvidia (NASDAQ: NVDA) has risen approximately 23,000% over the past decade, significantly outpacing the S&P 500 index, which gained around 220% in the same period. Currently, Nvidia constitutes roughly 8% of the S&P 500 and over 17% of the Vanguard Information Technology ETF (NYSEMKT: VGT), raising concerns about market bubbles due to high concentration in AI-related stocks.

Investors are being advised to consider diversifying their AI investments through the First Trust Nasdaq Artificial Intelligence and Robotics ETF (NASDAQ: ROBT). This ETF aims for diversification by unevenly weightings its holdings, with the largest position accounting for just over 2% of assets, and includes 113 holdings. The ETF focuses on maintaining risk management amid potential market corrections linked to inflated AI valuations.

“`