Ten Titans Drive S&P 500 Gains

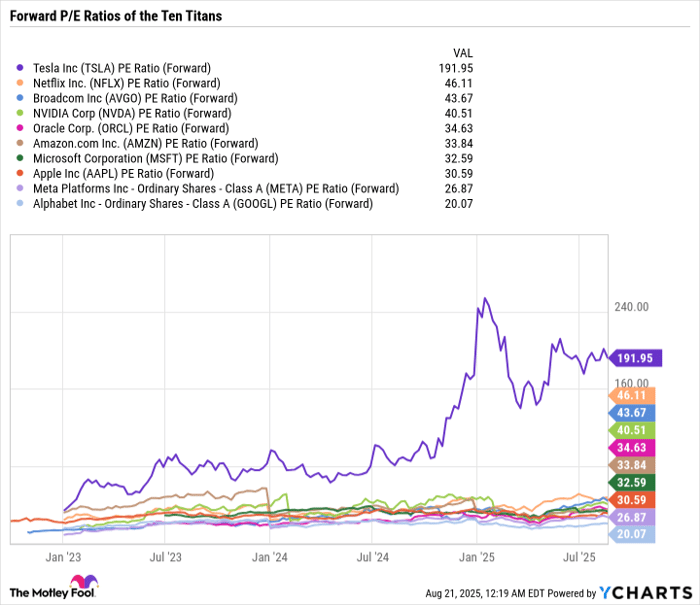

The Ten Titans—Nvidia, Microsoft, Apple, Amazon, Alphabet, Meta Platforms, Broadcom, Tesla, Oracle, and Netflix—have contributed 51.6% of the S&P 500’s growth over the past decade. This group collectively holds a market cap of $20.2 trillion, a significant increase from $2.5 trillion ten years ago.

Notably, these stocks now account for approximately 38% of the S&P 500, which has a total market cap of $34.3 trillion, up from $18.2 trillion a decade ago. Investment firm Vanguard’s S&P 500 ETF, with an expense ratio of just 0.03%, allows investors to gain exposure to this concentration of growth, although it is becoming less diversified.

Due to the heavy concentration of these mega-cap companies, the S&P 500 has evolved into a growth-focused index, which may not suit all investors, especially those seeking balance or dividend-paying stocks.