Nvidia’s Stock Decline Shapes AI Investment Landscape

The market’s reaction to Nvidia (NASDAQ: NVDA) stock has been unfavorable recently, with shares falling 30% year-to-date. Analysts have adjusted their growth forecasts downwards for the chipmaker as valuations decrease. Currently, Nvidia’s shares trade at a mere 18.4 times sales, marking its lowest multiple since 2023.

Emerging Opportunities in AI Investment

Investors may consider Nvidia a solid buy following the market’s corrections of early 2025. However, for those seeking bargain opportunities within the artificial intelligence (AI) sector, two lesser-known companies offer unique advantages and potentially greater growth than Nvidia.

SoundHound AI: Small Company with Big Potential

For enhanced exposure to AI, SoundHound AI (NASDAQ: SOUN) presents an attractive option. With a market capitalization of $3.3 billion, SoundHound is one of the smallest public firms significantly involved in the AI landscape. It specializes in applications related to audible speech, including automated drive-throughs and AI customer service agents.

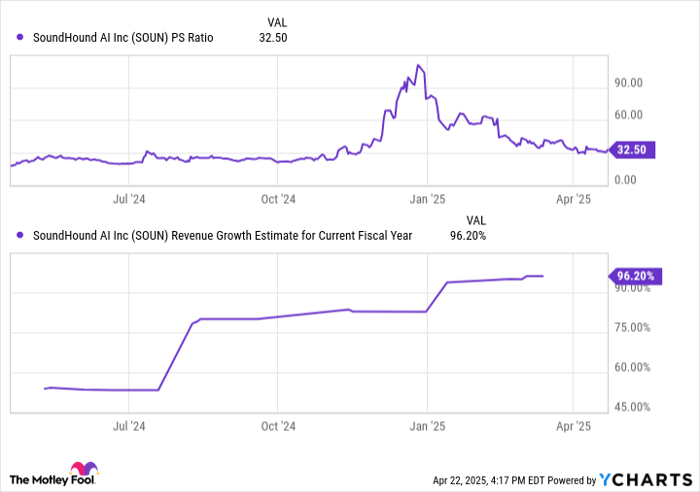

A report from SNS Insider predicts that the AI voice generator market, currently valued at $3.2 billion in 2023, will soar to a $40 billion market by 2032. Recently, SoundHound reported a 101% year-over-year revenue increase, reaching $34.5 million. The stock currently trades at 32.5 times sales, indicating that investors might already anticipate strong growth. However, the true potential of the AI sector may yet be underestimated.

Although SoundHound boasts significant upside potential due to its size, competition from tech giants with substantial R&D budgets poses a risk. Notably, many of these larger players are heavily investing in voice AI, which may impact SoundHound’s market position and valuation.

SOUN PS Ratio data by YCharts.

Is Palantir a Stronger AI Investment Than SoundHound?

For those seeking a lower-risk investment with substantial upside, Palantir Technologies (NASDAQ: PLTR) could be appealing. Although not solely an AI company, Palantir’s growth will be influenced by its AI initiatives. With a market capitalization of approximately $210 billion, it is considerably larger than SoundHound but remains less than a tenth the size of Nvidia, valued at $2.4 trillion.

Palantir recently saw its stock price rise after NATO announced it would officially adopt its AI-driven military system. This development reinforces confidence in Palantir’s products and signals its crucial role in evolving global military systems.

NVDA PS Ratio data by YCharts.

However, potential investors should note that Palantir stock is currently costly, trading at 80.5 times sales. Despite anticipated sales growth of around 30% for 2025 and 2026, this valuation presents a notable premium. In contrast, Nvidia trades at just 18.8 times sales and anticipates nearly double the revenue growth this year. In terms of profitability, Nvidia presents a more attractive option, with shares trading at 33.7 times trailing earnings and 22.4 times forward earnings, lower than Palantir’s valuations.

While both SoundHound and Palantir show promise, Nvidia’s more favorable valuation and established leadership in the AI GPU market continue to position it as a strong core holding. Investors may benefit by allocating smaller positions to both SoundHound and Palantir for portfolio diversification without giving up on Nvidia.

Should You Invest $1,000 in SoundHound AI Now?

Before deciding to invest in SoundHound AI, consider the insights from financial analysts:

The Motley Fool analyst team has highlighted ten high-potential stocks, notably excluding SoundHound. These identified stocks may yield considerable returns in the coming years.

For example, Netflix was recommended on December 17, 2004, and a $1,000 investment then would now be worth $566,035. Likewise, Nvidia, which was highlighted on April 15, 2005, would now be worth $629,519.

The Motley Fool Stock Advisor has achieved an average return of 829%, significantly outperforming the S&P 500’s 155%. Investors looking for top recommendations can access these insights upon joining the Motley Fool.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions presented in this article reflect those of the author and do not necessarily represent those of Nasdaq, Inc.