Twilio Inc. (TWLO) reported a 12% year-over-year revenue increase for Q1 2025, although its non-GAAP gross margin contracted by 280 basis points. The company is focusing on cross-selling multiple products to enhance customer loyalty and profitability. Notably, its large clients, those spending over $500,000 annually, grew by 37% year-over-year, highlighting the success of its cross-selling strategy.

Twilio’s forward price-to-sales ratio stands at 3.56, lower than the industry’s average of 5.65. The Zacks Consensus Estimate for Twilio’s earnings indicates a projected year-over-year increase of approximately 22.3% in 2025 and 13% in 2026, although recent revisions for 2026 have decreased.

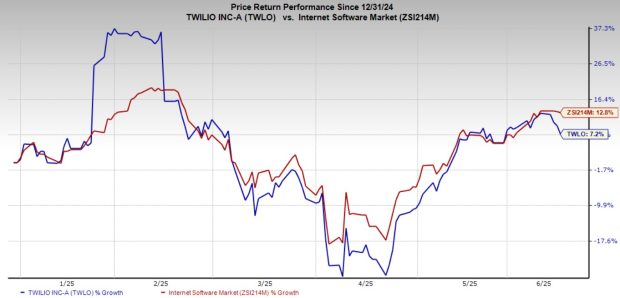

Despite a 7.2% increase in stock value year-to-date, Twilio faces significant competition from companies like RingCentral and Bandwidth, both of which are also pursuing cross-selling strategies to maximize customer engagement and revenue.