Analyst Target Prices Indicate Potential Growth for Vanguard Consumer Staples ETF

At ETF Channel, we analyzed the underlying holdings of various ETFs and compared their current trading prices to average analyst forecasts. For the Vanguard Consumer Staples ETF (Symbol: VDC), the average analyst 12-month target price is set at $237.73 per unit.

Significant Upside Potential Identified

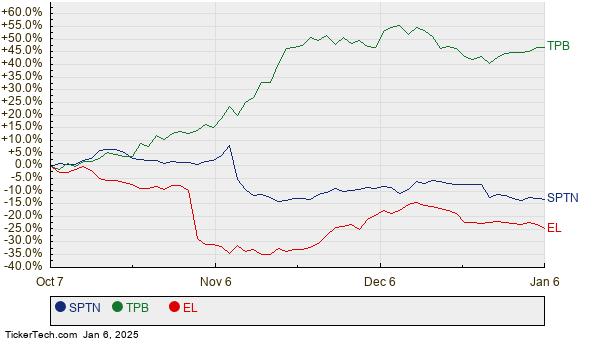

Currently trading at approximately $211.14 per unit, VDC presents an upside potential of 12.60% based on these analyst targets. Three key holdings show notable upside: SpartanNash Co (Symbol: SPTN), Turning Point Brands Inc (Symbol: TPB), and Estee Lauder Cos., Inc. (Symbol: EL). Despite SPTN’s recent trading price of $18.18 per share, analysts project a target of $22.33 per share, which represents a 22.84% increase. TPB shows a 13.24% upside potential from its current price of $60.71, with an average target of $68.75 per share. Analysts expect EL’s share price to rise 12.92% from its recent price of $72.16, reaching a target of $81.48. Below, you can see a chart of the past twelve months’ performance for SPTN, TPB, and EL:

Summary of Analyst Targets

Below is a table summarizing the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Consumer Staples ETF | VDC | $211.14 | $237.73 | 12.60% |

| SpartanNash Co | SPTN | $18.18 | $22.33 | 22.84% |

| Turning Point Brands Inc | TPB | $60.71 | $68.75 | 13.24% |

| Estee Lauder Cos., Inc. | EL | $72.16 | $81.48 | 12.92% |

Assessing Analyst Expectations

It is essential to consider whether analysts are justified in their target prices or if they are overly optimistic. This situation raises important questions about whether the targets reflect current conditions or are based on outdated information. While high target prices may indicate optimism, they could also lead to downward revisions if they fail to align with market realities. Investors are encouraged to conduct thorough research to assess these valuations.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding EGGF

• MIRM Stock Predictions

• Funds Holding LXFT

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.