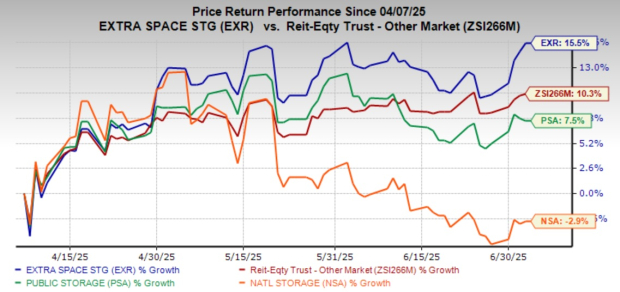

Extra Space Storage Inc. (EXR), the largest self-storage REIT in the U.S., has seen its share price increase by 15.5% over the past three months, outperforming its industry’s 10.3% gain. Meanwhile, competitors Public Storage (PSA) rose by 7.5%, and National Storage Affiliates Trust (NSA) saw a decline of 2.9%. The company’s recent Q1 2025 performance showed core funds from operations (FFO) per share at $2.00, exceeding the Zacks Consensus Estimate of $1.96, with same-store occupancy at 93.4%.

In the first quarter of 2025, Extra Space Storage acquired 12 stores for $153.8 million and added 113 stores to its third-party management platform. However, challenges such as potential pricing sensitivity among new customers and projected negative growth in same-store revenues (ranging from −0.75% to −1.25%) raise concerns about future performance. Despite solid fundamentals and annualized dividend growth of 12.61% over the past five years, the current valuation is considered stretched, with a price-to-FFO multiple of 18.38X, higher than its peers.

As of March 31, 2025, Extra Space Storage’s fixed-rate debt represented 78.8% of total debt, with an unencumbered asset value of 83.4% of total assets. Investors are advised to consider a “Hold” stance due to macroeconomic uncertainties, while new investors may be inclined to wait for a price pullback.