ExxonMobil Navigates Oil Market Turbulence with Strategic Resilience

Oil market turbulence has surged this year, with prices falling over 15% due to uncertainty around tariffs and other factors. The global oil benchmark, Brent, which previously hovered between $75 and $85 a barrel, has now dropped to approximately $60 a barrel.

While declining crude prices spell trouble for many producers, they do not pose a threat to ExxonMobil (NYSE: XOM). Over the past few years, the oil giant has positioned itself to thrive in challenging markets, making it a strong contender amid the current volatility.

Positioned for Market Challenges

ExxonMobil CEO Darren Woods recently addressed the state of the oil market during the company’s first-quarter earnings conference call:

“This uncertainty affects economic forecasts, leading to notable volatility and potential slower growth. Alongside a possible increase in OPEC supply, we are experiencing downward pressure on prices and margins. Therefore, focusing on our controllable factors and delivering positive results is crucial. Our efforts over the past eight years demonstrate that we are ready for this.”

Woods elaborated on Exxon’s advantage in navigating these conditions. He emphasized the company’s low-cost supply structure, robust balance sheet, and recent reductions in operational expenses. Notably, Exxon’s 7% net leverage ratio is leading among international oil companies (IOCs) and large-cap industrial firms. Since 2019, Exxon has cut $12.7 billion in structural costs, a feat unmatched by its competitors.

As Woods affirmed:

“We engage in pressure testing our plans under scenarios even more severe than our COVID experience. Our definition of success lies not in favorable conditions but emerges from overcoming challenges.”

This strategic positioning allows ExxonMobil to weather the current downturn in oil prices without significant pressure, giving it an edge over its competitors to seize potential opportunities.

Bright Long-Term Outlook

Despite short-term uncertainties, Woods assured stakeholders that “the longer-term fundamentals supporting our businesses remain strong.” He highlighted that the world will continue to depend on reliable and affordable energy. Consequently, Exxon is investing in projects aimed at low-cost oil and gas while also investing in future energy solutions like hydrogen, carbon capture and storage, biofuels, and lithium.

Woods expressed confidence in Exxon’s long-term strategy, predicting, “By 2030, we expect to achieve $20 billion more in earnings and $30 billion in cash flow, assuming constant prices and margins, thereby delivering enhanced shareholder value.”

The company plans to invest about $140 billion in major projects and its Permian Basin development program by 2030. Given its strong financial position, Exxon is well-prepared to maintain capital investments even if crude prices decline further. This readiness will allow it to continue advancing its low-cost projects to bolster margins and withstand future price dips. Furthermore, Exxon’s ongoing ventures in lower-carbon initiatives aim to stabilize earnings volatility through predictable long-term revenues.

Exxon also targets a total of $18 billion in structural cost savings by 2030 from a baseline established in 2019, with nearly $13 billion already secured.

ExxonMobil Poised for Growth Amid Market Volatility

The company has more than $5 billion in potential income it can realize over the next few years by enhancing its operations.

Built to Thrive in Challenging Markets

ExxonMobil has strategically invested in its advantaged assets and reduced structural costs, positioning itself to tackle recent market volatility effectively. The firm’s ongoing strategy aims to foster significant growth in earnings and cash flow. These investments are expected to bolster shareholder value in the coming years, even amidst unpredictable oil market conditions.

Is it a Good Time to Invest $1,000 in ExxonMobil?

Before purchasing shares in ExxonMobil, consider this caution:

The Motley Fool Stock Advisor analyst team has identified what they deem to be the 10 best stocks for investors today—and ExxonMobil did not make this list. The selected stocks are positioned to yield substantial returns over the next several years.

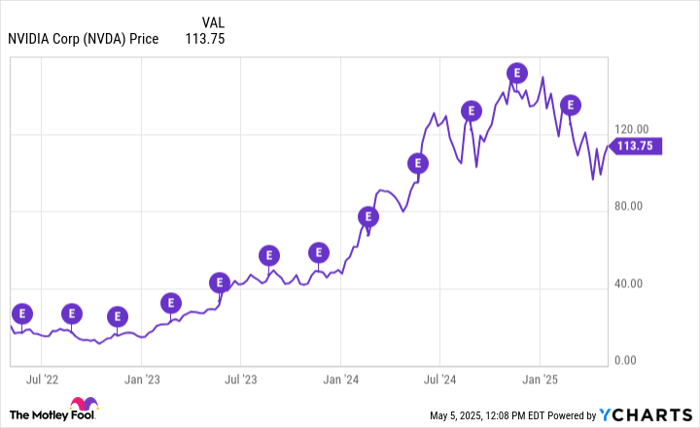

Recalling past successes: when Netflix appeared on this list on December 17, 2004, an investment of $1,000 at that time would now be worth $613,546! Similarly, Nvidia was included on April 15, 2005, and a $1,000 stake then would have grown to $695,897!

It’s important to note that Stock Advisor boasts an average return of 893%, significantly outperforming the S&P 500’s 162%.

*Stock Advisor returns as of May 5, 2025.

Matt DiLallo holds no positions in any stocks mentioned. The Motley Fool also has no positions in any stocks discussed. They maintain a disclosure policy.

The views in this article represent the author’s opinions and do not necessarily reflect those of Nasdaq, Inc.