F.N.B Corp. FNB is well-poised for revenue growth on the back of steady loan demand and efforts to bolster fee income. Higher interest rates and a strong balance sheet position are other tailwinds. However, rising expenses and weak asset quality are major concerns.

F.N.B. Corp. is focused on its revenue growth strategy. The company’s revenues witnessed a five-year (2018-2023) CAGR of 5.4%. Net loans saw a CAGR of 7.8% over the same time frame. The company is strategizing to bolster non-interest income by enhancing its product suite and expanding services. Strategic expansion moves like de novo expansion, along with a decent loan and deposits pipeline, will further boost the top line. We expect the net interest income to decline 1.7% this year and then rebound and grow 3.6% in 2025 and 2.2% in 2026. For 2024, we estimate non-interest income to jump 34.8% and net loans and leases to rise 4.6%.

The Federal Reserve hiked interest rates 11 times between March 2022 and July 2023 to control inflation and is likely to maintain the high interest rates in the near term. Supported by the higher interest rates, F.N.B Corp.’s net interest margin (NIM) is expected to keep improving. However, rising deposit costs will exert pressure on it. In 2023, NIM increased to 3.35% from 3.03% in 2022 and 2.68% in 2021. We project NIM to be 3.13% this year as higher funding costs exert pressure on it.

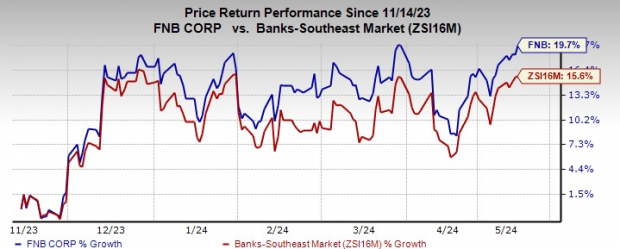

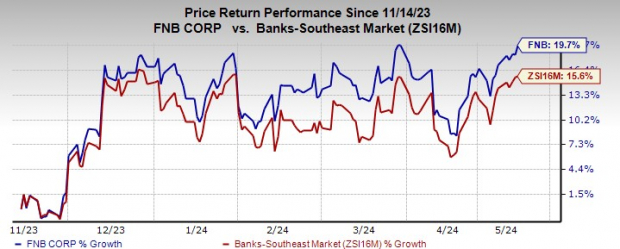

FNB currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 19.7% over the past six months, outperforming the industry’s growth of 15.6%.

Image Source: Zacks Investment Research

Despite the above-mentioned tailwinds, F.N.B. Corp.’s expenses have remained elevated over the past several years. Total non-interest expenses witnessed a CAGR of 5.7% in the past five years (2018-2023). Overall costs are expected to remain elevated as the company continues to invest in franchises, digitize operations and grow inorganically. Though we expect non-interest expenses to decline 1.2% in 2024, the metric will increase 1.8% and 1% in 2025 and 2026, respectively.

FNB’s asset quality has been weakened over the past few years. Although the provision for credit losses declined in 2021, it increased substantially in 2020, 2022 and 2023 as the company continued to build reserves to combat the tough operating environment. The likelihood of an economic slowdown is expected to keep provisions high in the near term. We expect provisions to increase 12.6% in 2024.

Bank Stocks to Consider

Some better-ranked bank stocks are First BanCorp. FBP and Bank7 Corp. BSVN.

First BanCorp’s earnings estimates for the current year have moved 6% north in the past 30 days. The company’s shares have gained 20.5% over the past six months. At present, FBP sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Bank7’s 2024 earnings estimates have been revised 1.3% upward in the past month. The company’s shares have rallied 18.5% over the past six months. Currently, BSVN carries a Zacks Rank #2 (Buy).

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Don’t Wait. Download FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

F.N.B. Corporation (FNB) : Free Stock Analysis Report

First BanCorp. (FBP) : Free Stock Analysis Report

Bank7 Corp. (BSVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.