F5’s Stock Surges 45.7%: A Deep Dive into Innovative AI Solutions and Market Challenges

F5 (FFIV) shares have grown by 45.7% year-to-date (YTD), outperforming the broader Zacks Computer and Technology sector, which saw a 34.9% increase. This strong performance highlights F5’s well-managed business and innovative strategies.

F5’s success can be attributed to its strong portfolio and commitment to application security, especially in multi-cloud environments. The company is continually enhancing its platforms with automated processes that speed up application provisioning.

In a recent development, F5 has partnered with MinIO, a leader in high-performance, Kubernetes-native object storage, to boost its artificial intelligence (AI) offerings. This collaboration aims to merge F5’s advanced traffic management and security technologies with MinIO’s scalable storage solutions, enhancing AI workloads, particularly at exascale levels. Together, they will facilitate hybrid and multi-cloud networking, ensuring robust security and efficient data flow essential for large AI deployments.

F5’s Innovative AI Gateway Enhances Business Prospects

F5 has made strides in its AI offerings. In November 2024, the company launched its AI Gateway, a containerized solution that simplifies enterprise AI deployment. This innovation streamlines secure connections between applications, APIs, and large language models.

The AI Gateway promotes cost efficiency, compliance, and threat mitigation. It also integrates seamlessly with F5’s BIG-IP and NGINX platforms, allowing for deployments across any data center or cloud environment.

In another significant move, F5 unveiled BIG-IP Next for Kubernetes in October 2024. This advanced solution for managing and securing AI applications provides organizations a centralized control point to enhance data traffic for extensive AI systems.

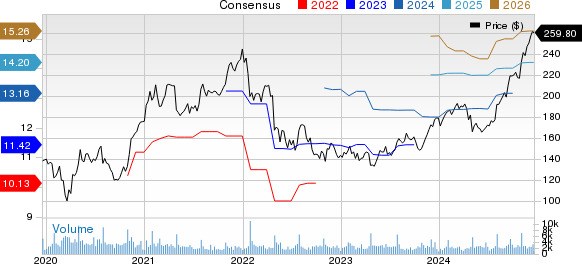

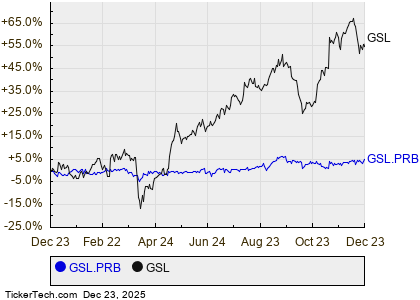

Analyzing F5, Inc. Price Trends

F5, Inc. price-consensus-chart | F5, Inc. Quote

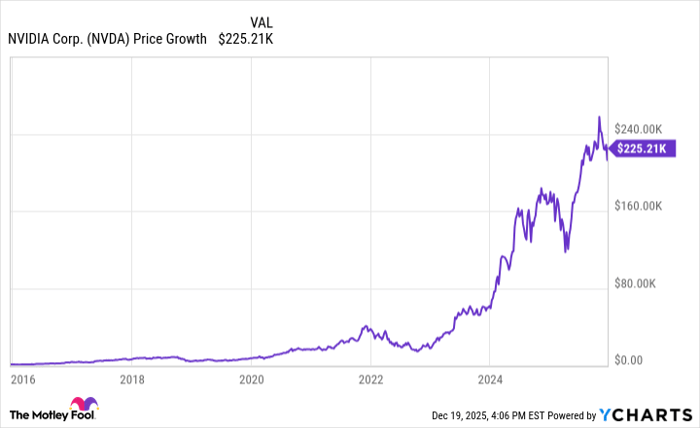

This solution utilizes powerful NVIDIA (NVDA) BlueField-3 DPUs to enhance the efficiency of data center traffic, a crucial component for large-scale AI initiatives. By integrating networking, traffic management, and security, customers can optimize the performance of their AI applications.

F5 also recently announced a partnership with OVHcloud US, extending its distributed cloud services to OVHcloud customers. This collaboration will facilitate uniform application security policies while simplifying networking across different infrastructures.

Additionally, in September 2024, F5 and NetApp expanded their partnership to enhance multi-cloud networking and accelerate enterprise AI capabilities. This collaboration aims to facilitate the use of large language models in hybrid cloud setups, thereby improving the effectiveness, security, and performance of AI systems.

F5 introduced the F5 NGINX One, a comprehensive package that combines web and application server features, API gateway functionalities, and advanced security options. This unified approach enables efficient management and enhanced visibility for customers, allowing faster app deployment and advanced capabilities like AI integration.

Current Risks for F5: Competition and Market Environment

While F5 excels in application security and load balancing, it faces stiff competition from Cisco, which has a more extensive network infrastructure and cloud solutions portfolio. Cisco’s substantial resources can pose challenges for F5 as they overlap in various services, such as network security and load balancing.

Other competitors, including Cloudflare (NET), Fortinet (FTNT), and Microsoft’s Azure Application Gateway, also present significant competition with similar services. For instance, Cloudflare’s DDoS mitigation competes directly with F5’s BIG-IP and NGINX offerings.

Adding to the competitive pressures, F5’s near-term prospects are hampered by slowed IT spending. High interest rates and persistent inflation have influenced consumer spending, while many businesses are delaying significant IT investments amid a weakened global economy and ongoing geopolitical tensions. This trend could adversely affect F5’s revenue growth.

As a result, F5 anticipates modest sales growth of only 4-5% for fiscal 2025. Analysts expect revenues to reach $2.94 billion, reflecting a year-over-year increase of 4.6%. Earnings are projected at $14.20, indicating a 6.2% growth from the previous year.

What Should Investors Consider for F5?

Despite the hurdles stemming from competition and the uncertain economic landscape, F5 remains a strong contender in the application delivery and security sectors, thanks to its pioneering AI products.

The company’s innovative trajectory may lead to positive long-term growth prospects. However, caution is advisable due to its current valuation, reflected in a Zacks Value Style Score of C.

F5 currently holds a Zacks Rank #3 (Hold), suggesting that current investors should maintain their positions while prospective buyers might want to wait for a more advantageous entry point. You can also view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Explore Profitable Opportunities in the Nuclear Energy Sector

The surge in electricity demand, paired with a move away from fossil fuels, has spotlighted nuclear energy as a viable solution.

Recently, leaders from the US and 21 other nations agreed to triple the world’s nuclear energy capacity. This significant transition could yield considerable profits for investors who act promptly in the nuclear sector.

Our urgent report, Atomic Opportunity: Nuclear Energy’s Comeback, delves into pivotal players and technologies, highlighting three key stocks set to benefit significantly.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

For the latest recommendations, download our report on 5 Stocks Set to Double.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

F5, Inc. (FFIV): Free Stock Analysis Report

Fortinet, Inc. (FTNT): Free Stock Analysis Report

Cloudflare, Inc. (NET): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.