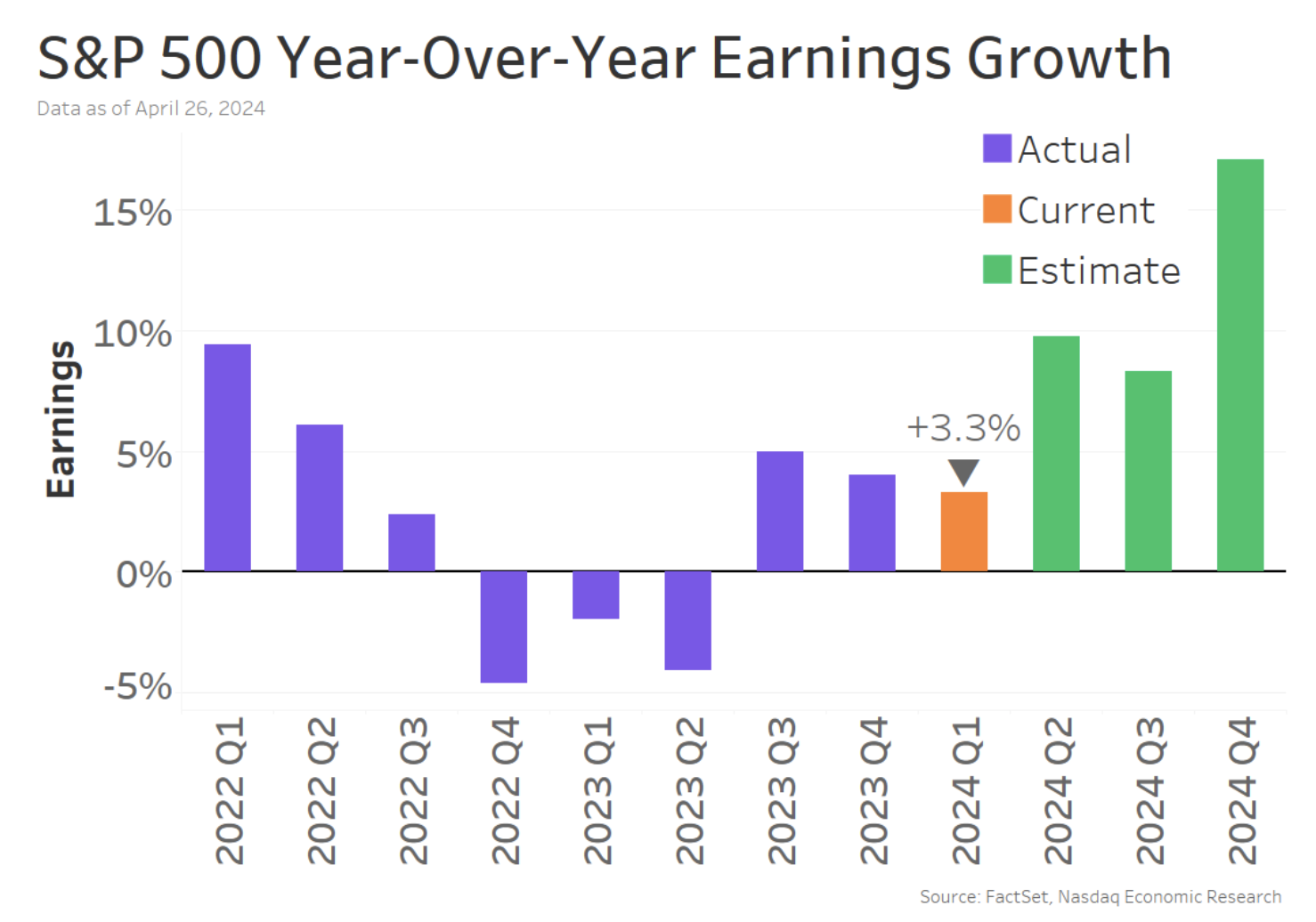

Large cap earnings growth stays positive in Q1

We’re in the thick of Q1 earnings season, with 45% of S&P 500 firms having reported. And earnings are on pace to grow +3.3% YoY (chart below, orange bar):

That’s a bit slower than Q4’s 4% pace, but as more earnings come in, we might see that move higher. That’s because, as we’ve shown before, data shows US companies tend to manage expectations lower ahead of earnings season, then beat analysts’ projections.

Consistent with that, so far, 77% of S&P 500 firms have beaten Q1 estimates – right in line with the 5-year average.

Higher rates contributing to negative earnings growth for mid- and small caps

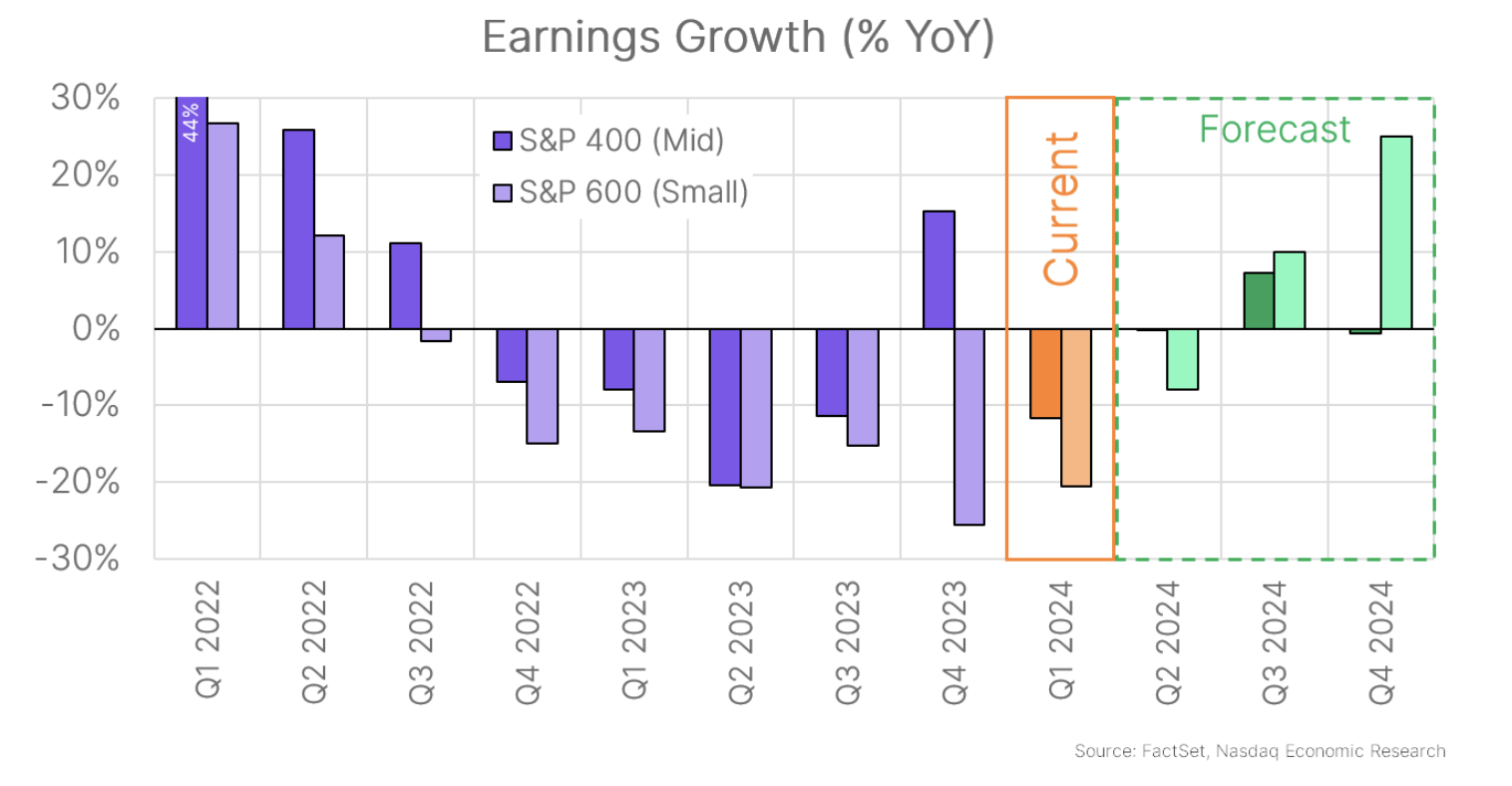

However, earnings still aren’t looking as good for smaller stocks.

- Mid-caps: Ended their year-long earnings recession with a positive Q4, but are expected to see earnings fall 12% YoY in Q1 (chart below, darker bars).

- Small caps: are doing even worse, on pace for earnings to fall 20% YoY (lighter bars) – their seventh straight quarter of negative earnings growth. Although forecasts show them with a stronger recovery through end-2024.

Debt (and higher rates) helps explain the gap. Small caps have a 5x larger share of debt that’s floating rate compared to large caps. So they’re feeling the Fed’s rate hike more than larger companies.

Not all large caps are doing well

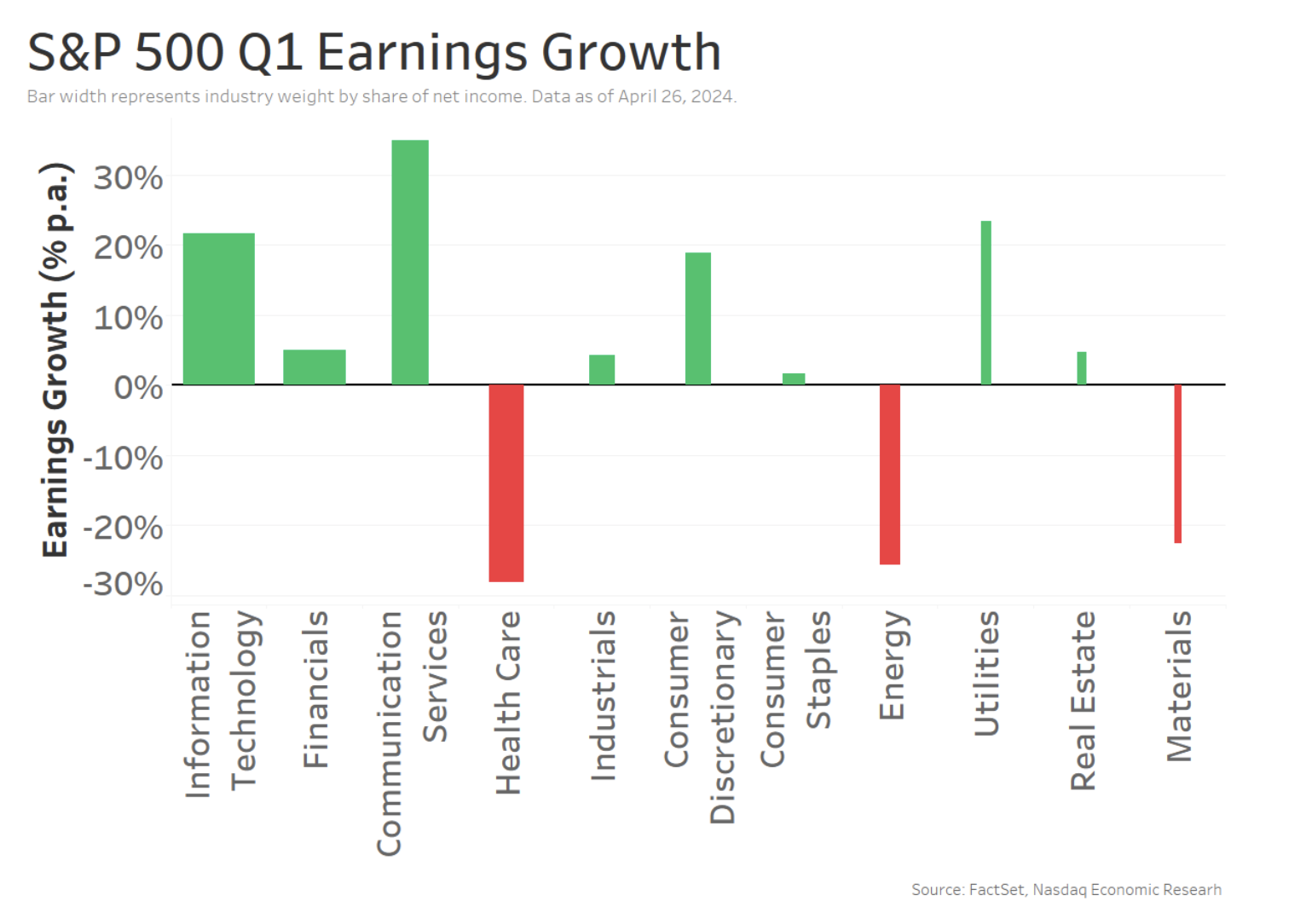

Looking at large caps by sector, a few sectors are also seeing earnings decline in Q1 – continuing a trend we’ve seen since Q2 2023:

- Health Care (continued drop in Covid-related spending),

- Energy (even though oil prices are flat YoY, natural gas prices are down 25% YoY), and

- Materials (facing drag from the tail end of the manufacturing recession).

In contrast, Consumer- and AI-driven sectors are seeing the strongest growth, with Information Technology (Nvidia, Microsoft, Super Micro), Communication Services (Meta, Netflix, Google), and Consumer Discretionary (Amazon, Hasbro, Airbnb) are all on pace for 20+% YoY earnings growth.

Mega-caps drive Q1 earnings

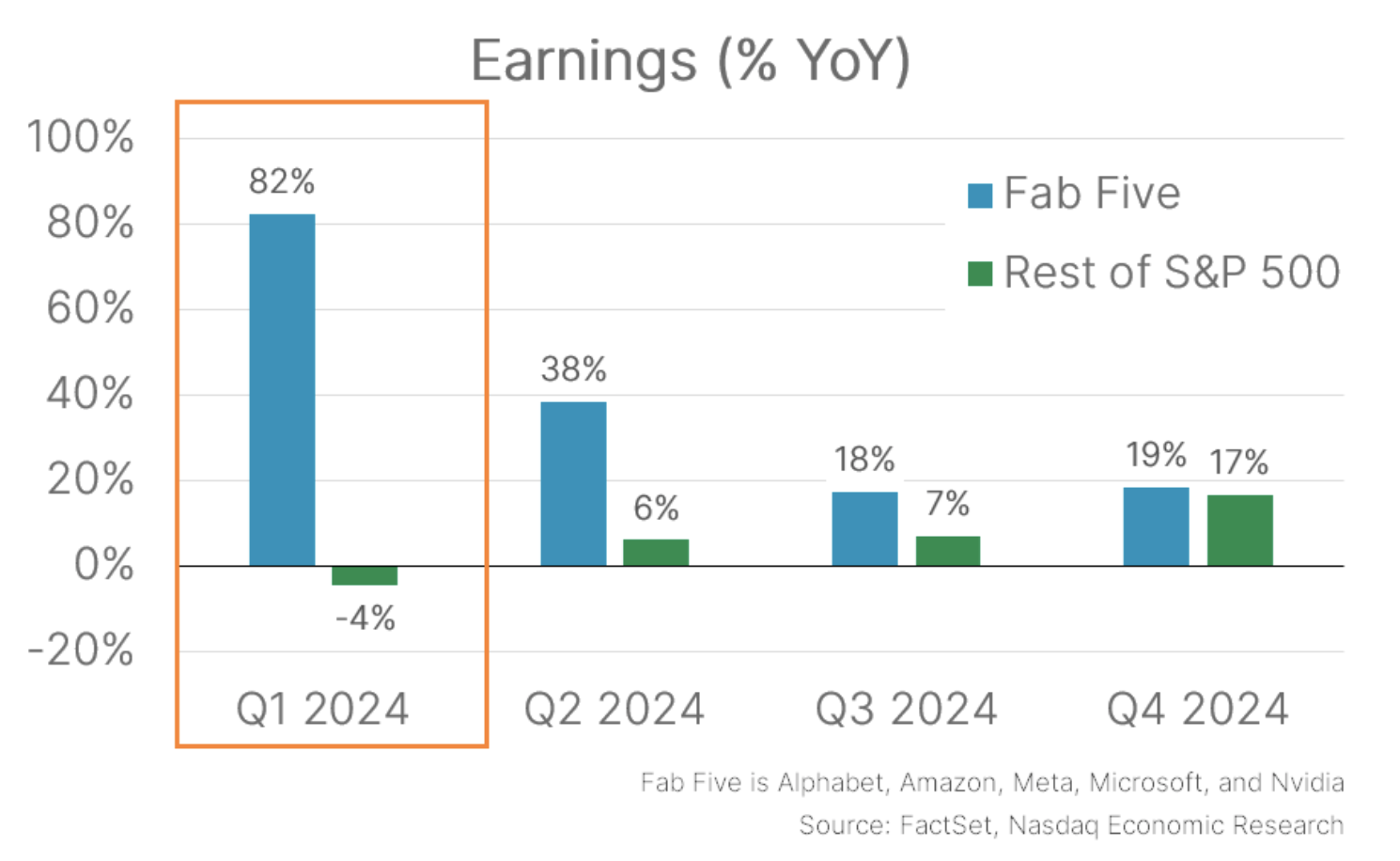

Which brings us to the earnings of the Magnificent 7 – all of which have become Mega-Caps. Perhaps the starkest divide for earnings is between mega-caps and everyone else.

Although not all the “Mag 7” are doing well. Apple and Tesla’s prices have recently fallen, and those stocks have fallen out of the newly dubbed “Fab Five” (Amazon, Google, Meta, Microsoft, and Nvidia – which is a better performing subset).

In fact, these five companies actually account for all the Q1 earnings growth in the S&P 500 and then some. They’re expected to see +82% YoY earnings growth in Q1 (chart below, blue bars), compared to negative 4% YoY for the rest of the S&P 500 (green bars).

But earnings growth expected to broaden later this year

However, as the year goes on, the S&P 500 is expected to become less reliant on these mega-cap stocks as earnings growth broadens out. The rest of the S&P 500 is expected to see positive earnings growth from Q2, and come into line with the Fab Five’s earnings growth by Q4.

Importantly, it’s true that the Fab Five’s recent returns (up 150% since late 2022) have been driven by real earnings and growth. However, there are signs the market wants proof that growth will continue despite record revenues, Meta sold off following Wednesday’s earnings report in part due to comments on its earnings call about increased spending on artificial intelligence. At the same time, Microsoft rose after its report yesterday, seeing revenue gains in its cloud business that helps power its AI solutions.

In short, at some time actual profits are important to valuations. Especially if the stock has been pricing them in already for a while.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved.