Fabrinet Faces a Critical Moment: Growth Potential Meets Short-Selling Risks

The optical component manufacturer Fabrinet FN finds itself in a unique position with potential for significant growth alongside escalating short-selling interest.

Fabrinet is benefiting from the increasing demand driven by Nvidia Corp NVDA for 1.6T transceivers. As noted by JPMorgan analyst Samik Chatterjee, this demand might lead to an “outsized beat and raise” in the near future.

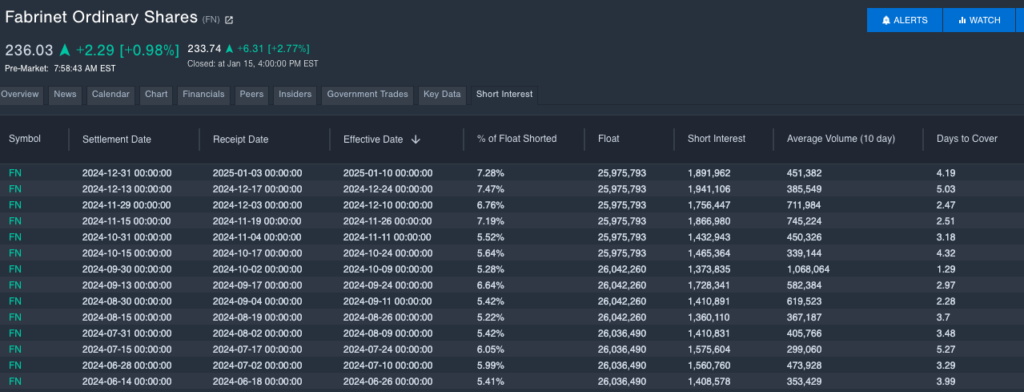

Despite such optimism, Fabrinet’s short interest has risen by 10.2% in December, with 7.28% of its shares currently sold short.

Table Source: Benzing Pro

This situation poses a significant risk for those betting against Fabrinet, especially if unexpected positive outcomes arise.

Explore Further: Fabrinet: The AI Secret Weapon Driving Nvidia’s Data Center Expansion

Nvidia’s Surge and Short-Seller Challenges

Chatterjee expresses caution concerning the increasing short interest in Fabrinet shares ahead of earnings. He indicates that the ongoing ramp of the 1.6T transceivers could lead to unexpected positive results.

Although the industry has faced challenges such as component shortages and delayed GPU launches, new Datacom projections present a much more favorable outlook. The market forecast for 400G+ in 2025 has increased from $7 billion to an impressive $12 billion, with 800G anticipated to lead the way.

Specifically, the 1.6T ramp amid Nvidia’s growth seems solid, even while uncertainty surrounding non-Nvidia demands exists.

Promising Growth Ahead

Fabrinet is expected to show growth in both revenue and earnings. For the second quarter of fiscal 2025, Chatterjee predicts revenue to reach $821 million, surpassing the consensus estimate of $812 million.

He anticipates gross margins at 12.7% and earnings per share (EPS) at $2.51, both slightly above market expectations.

Looking forward, revenue for the third quarter of fiscal 2025 is projected at $841 million, further affirming the company’s positive trajectory.

Will Short-Sellers Face the Heat?

With Fabrinet trading at a high valuation and strong demand from Nvidia, short sellers may be engaging in a risky strategy. The stock has declined nearly 12% in the last six months. However, the growing demand for optical components may create favorable pricing conditions for suppliers.

If Fabrinet achieves an unexpected positive result, a significant short squeeze could occur.

Chatterjee warns against betting against Fabrinet with Nvidia’s support. As short interest rises and potential for upside surprises looms, Fabrinet could lead to regret for short sellers and joy for investors.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs