“`html

Alphabet’s Stock Performance and AI Investment

Shares of Alphabet (NASDAQ: GOOG) increased by over 4% in pre-market trading, reflecting a “flight to quality” among investors in the AI sector. This uptick comes amid growing concerns about the sustainability of returns on AI investments, particularly from the hyperscaler companies. In 2022, Google Cloud reported a loss of $3 billion on $26.3 billion in revenue but is projected to achieve $8.6 billion in operating income on $41 billion in revenue during the first nine months of 2023.

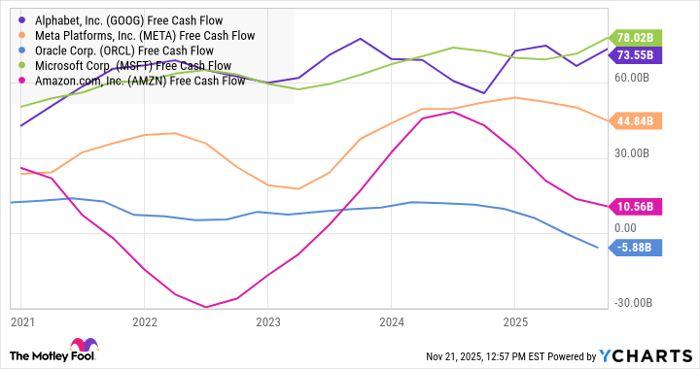

Investors are wary of a potential bubble in AI and data center stocks, with notable figures like Michael Burry pointing to doubts about the longevity of network equipment and servers as a risk factor for disappointing returns on capital investments. Despite these concerns, Alphabet’s strong cash flows, primarily from Google Advertising, position the company favorably to continue funding its AI initiatives.

“`