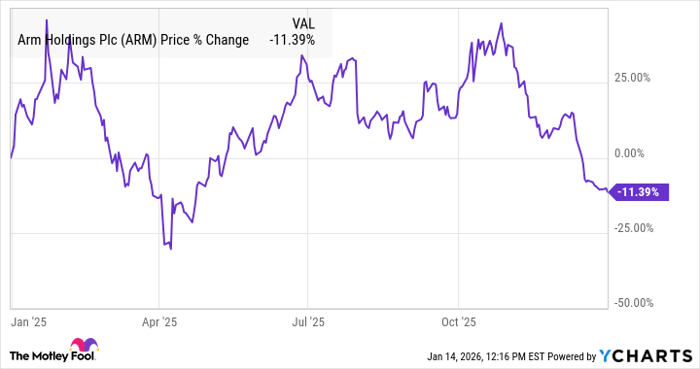

**Arm Holdings (NASDAQ: ARM) experienced a volatile year in 2025, finishing down 11% despite strong performance and growth opportunities in the AI sector. The key driver was its involvement in the $500 billion Stargate Project, alongside major players like Nvidia, Oracle, and OpenAI. However, broader market fluctuations and concerns over the potential AI bubble affected its stock prices.**

**For the first half of its fiscal year, Arm reported a 24% revenue growth, though its growth rate remains inconsistent due to its licensing business model. Looking ahead, the company projects $1.225 billion in revenue for the third quarter, marking a 24% increase year-over-year, with adjusted earnings per share expected at $0.41, up from $0.39.**