Dogecoin Struggles Amid Tariff Uncertainty on Thursday

Dogecoin (CRYPTO: DOGE) fell by 0.3% on Thursday by 4:00 p.m. ET, as investors shifted focus to stocks amid rising tariff uncertainty. The S&P 500 closed higher by 0.3%.

Ongoing Tariff Concerns

As a speculative investment, Dogecoin, which began as a satirical project, remains highly volatile, especially during periods of economic uncertainty. The tariffs from the Trump administration continue to affect investor sentiment.

A ruling from the Court of International Trade declared some tariffs illegal, but an appeals court temporarily halted that ruling, maintaining confusion in the market.

The potential negative impact of tariffs on the U.S. and global economy often prompts investors to move from speculative assets like cryptocurrencies to safer options, such as government bonds or blue-chip stocks. This uncertainty hindered Dogecoin’s market performance on Thursday.

Alternatives: Utility Cryptocurrencies

While some tariffs have been moderated, many remain intact, indicating a prolonged legal and market struggle. Investors may find it prudent to consider more utilitarian cryptocurrencies like Ethereum (CRYPTO: ETH) or Solana (CRYPTO: SOL).

Is Investing $1,000 in Dogecoin Wise?

Before investing in Dogecoin, note that it was not included in the latest recommendations from the Motley Fool analyst team, which highlighted ten stocks expected to yield significant returns.

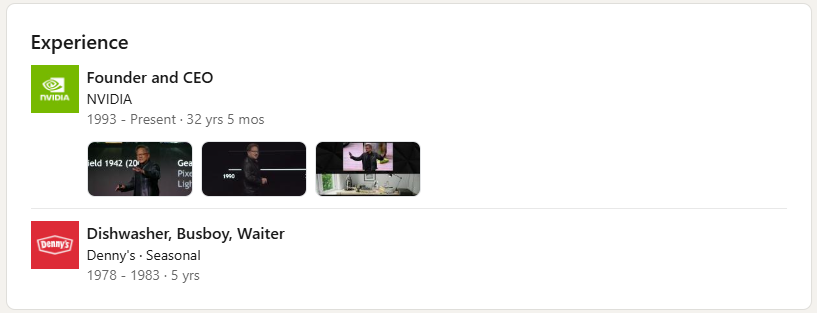

For context, an investment in Netflix back in December 2004 would have grown to $651,761 today, while Nvidia’s investment from April 2005 would have turned into $826,263.

Overall, these stocks have shown an average return of 978%, significantly outperforming the S&P 500’s 170%.

Eric Volkman has positions in Ethereum. The Motley Fool recommends Ethereum and Solana.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.