Astera Labs Shares Plummet After Analyst Downgrade

Recent analysis by Morgan Stanley triggers significant drop in stock value.

Astera Labs (NASDAQ: ALAB) has seen its stock decline this week following an update from analysts. The semiconductor company’s stock price dropped as much as 15.8% by Thursday before pulling back to a 7.1% decrease for the week, according to S&P Global Market Intelligence.

Analyst Shift Caps Gains for Astera Labs

This downturn comes after Morgan Stanley issued new coverage on Astera Labs, adjusting its rating from overweight to equal weight. The firm maintained its one-year price target at $142 per share.

Previously, the stock had shown significant growth. However, Morgan Stanley’s new assessment suggests that the stock no longer holds enough upside potential to warrant a buy recommendation. Their price target of $142 now implies about 14.8% potential upside, revising the previous estimate that indicated a 6.6% increase.

What Lies Ahead for Astera Labs?

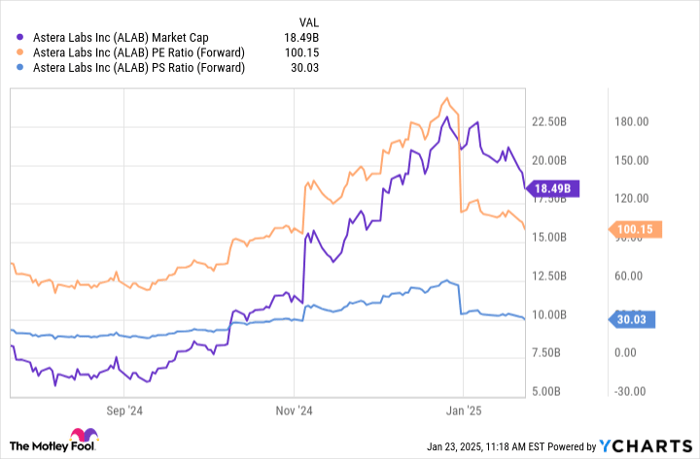

Despite the recent setbacks, Astera Labs’ stock has increased approximately 134% in the last six months. The company boasts a market capitalization of around $18.5 billion, with valuations at 30 times expected sales and 100 times expected earnings.

ALAB Market Cap data by YCharts

Astera Labs has experienced robust growth linked to the rising demand for artificial intelligence (AI) technologies. Its components are integral to Nvidia processors, and the company’s sales patterns reflect the overall success of AI-centered firms in the semiconductor space.

In its most recent quarter, Astera Labs reported a revenue surge of 206% year-over-year, reaching $113.1 million. The impressive gross margin of 77.7% indicates a promising future for earnings, assuming sales continue on this upward trajectory. Investors should be aware that Astera Labs will announce its fourth-quarter results and conduct a conference call after the market closes on February 10, offering insights into its latest performance and market trends.

Is Astera Labs a Smart Investment Right Now?

Before deciding to invest $1,000 in Astera Labs, consider this:

The Motley Fool Stock Advisor team recently highlighted what they believe are the 10 best stocks for investment at this time, and Astera Labs was not included in that list. These selected stocks may offer substantial returns in the coming years.

For perspective, consider Nvidia. If you had invested $1,000 when it was recommended on April 15, 2005, it would have grown to $901,323. *

Stock Advisor offers a clear pathway to successful investing, with regular updates, portfolio building advice, and two fresh stock picks each month. Since its inception, Stock Advisor has significantly outperformed the S&P 500 by more than four times.*

Discover more »

*Stock Advisor returns as of January 21, 2025

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.