Surprise in Bond Market: Long-Term Rates Rise Amid Good Economic News

10-year Treasury Yields Surge 60 Basis Points in Just 6 Weeks

In the last six weeks, financial markets have shown a mix of positive developments:

- Macro data have been better than expected.

- Equities reached record highs consistently.

- The Fed initiated its rate cut cycle with a 50 basis points reduction late last month.

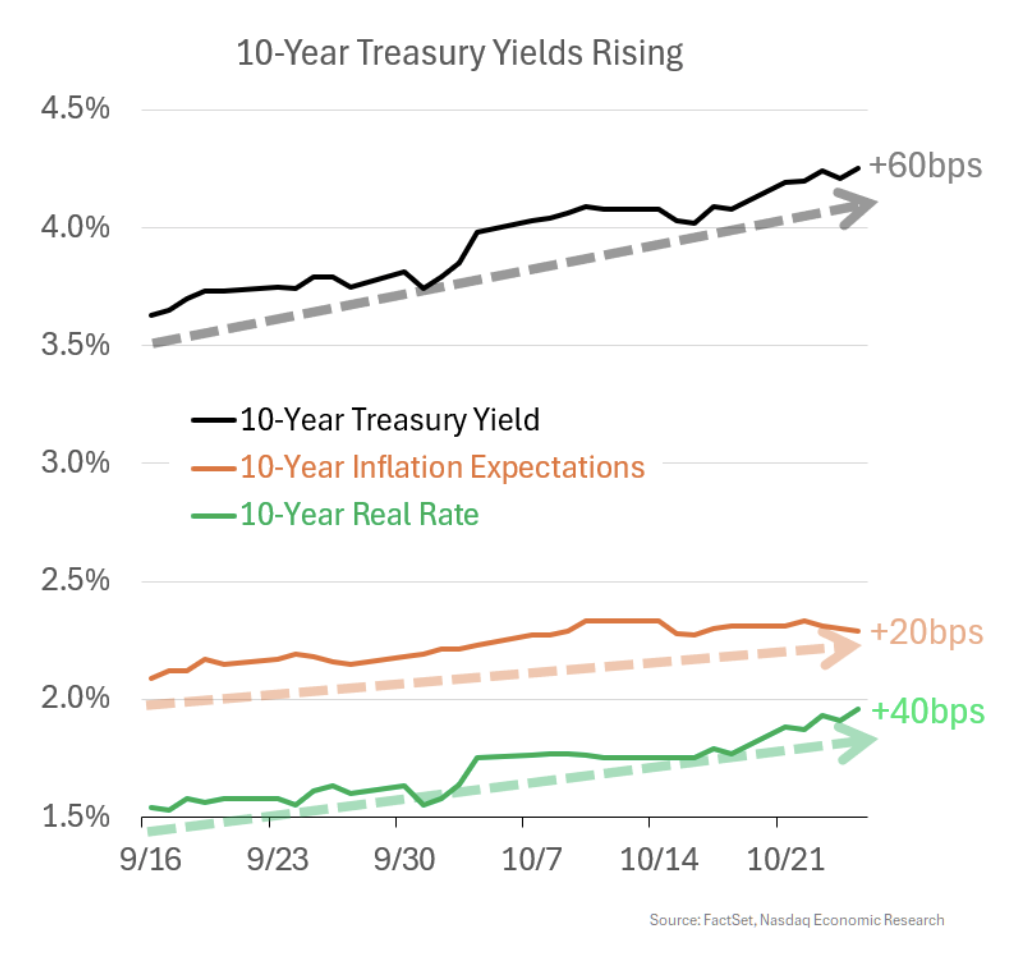

Despite this optimistic backdrop, long-term bonds have experienced a sell-off, with 10-year Treasury yields climbing 60 basis points since mid-September to exceed 4.25%.

Understanding 10-Year Yields: Inflation and Real Rates at Play

To grasp this situation, it is essential to look at the components that shape the 10-year Treasury yield. You can think of it as the combination of:

The recent 60 basis points increase in the 10-year Treasury yield (depicted by the black line in the chart below) is influenced by both the inflation expectations (orange line) and real rate (green line) components.

Rising Inflation Expectations Driven by Economic Strength and Global Tensions

10-year inflation expectations have increased by 20 basis points (orange line) to 2.3%. Several factors contribute to this rise:

- Increasing geopolitical tensions, which can heighten energy prices.

- Analysts predict that both presidential candidates will pursue more government spending, which could lead to heightened inflation expectations.

- A stronger economy is anticipated to drive up demand, further adding to inflationary pressures.

Real Rates Rise as Economy Strengthens and Recession Risks Decline

Real rates on the 10-year yield have climbed 40 basis points (green line), reaching 1.95%. This increase stems from various influences:

- The Fed’s shift towards rate cuts lessens recession fears, potentially leading to stronger economic growth over the next decade.

- Robust economic data over recent months—including the addition of 254,000 jobs in September and a Services PMI reaching a 17-month high—has further diminished recession risks.

- More government spending expectations, mentioned earlier, will likely support economic growth.

Growing Government Debt Elevates Credit Risk and Term Premium

An additional factor impacting yields is the rising term premium. This represents the extra yield investors demand for taking on the risk associated with long-term debt compared to short-term options. The term premium has risen by 45 basis points (red line) to 0.2%.

It is important to note that this term premium overlaps with both inflation expectations and real components. However, it signifies a distinct concern. Analysts forecast that increased government spending will contribute to a burgeoning debt load, predicting that government debt as a percentage of GDP will climb by 30%-40% over the next decade from approximately 100% today.

This anticipated rise in debt raises concerns about the risk of default, making long-term debt more precarious to hold.

Fed Rate Cuts and Rising Long-Term Rates: An Unlikely Pair

Even as the Fed moves to reduce short-term rates, the combination of economic factors points to a continued rise in long-term yields. With the jobs report set to release on Friday and elections occurring next week, investors should prepare for potential significant shifts in long-term rates within the coming days.

This content is for informational and educational purposes only and should not be construed as investment advice. Nasdaq, Inc. and its affiliates do not endorse any specific security or investment strategy. Statements about Nasdaq-listed companies or Nasdaq proprietary indexes do not guarantee future performance, and actual results may differ significantly. Past performance is not indicative of future results. Investors are encouraged to conduct their own diligence and consult with a securities professional before making investment decisions. © 2024. Nasdaq, Inc. All rights reserved.