“`html

The U.S. labor market shows signs of weakness as the unemployment rate for September remained at 4.34%, just shy of a potential rise to 4.4%, the highest level since October 2021. Layoffs have surged, with 202,118 planned by U.S. employers in the third quarter of 2025—the highest Q3 total since 2020. Year-to-date job cuts have totaled 946,426, reflecting a 55% increase from last year.

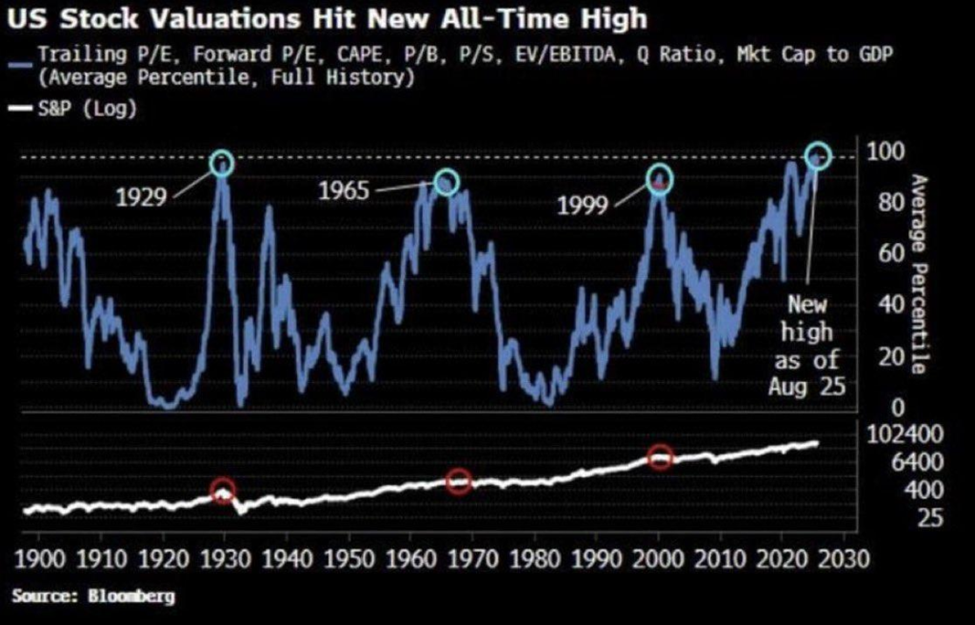

Despite these concerning indicators, the S&P Index touched a new all-time high this morning. Market analysts caution that current stock valuations are at unprecedented highs, surpassing levels seen during the Dot Com Bubble and the lead-up to the Great Depression. The prevailing sentiment suggests that while a market crash may not be immediate, it is considered inevitable over time.

Upcoming significant changes are anticipated with the launch of “Project Yorktown” on October 21, a four-page plan believed to potentially reshape America’s financial future and redirect $4 trillion into overlooked market segments, sparking interest among investors.

“`