Constellation Energy Corporation (CEG) is leveraging its diverse clean energy portfolio, primarily nuclear and energy trading expertise, to capitalize on the growing demand for clean energy, driving revenue growth and profitability. The company boasts an owned generation capacity of over 32,400 megawatts, making it the leading source of wholesale energy in the United States, with a trading desk that ranks as the third largest in the country.

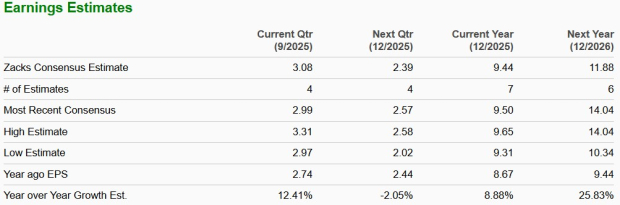

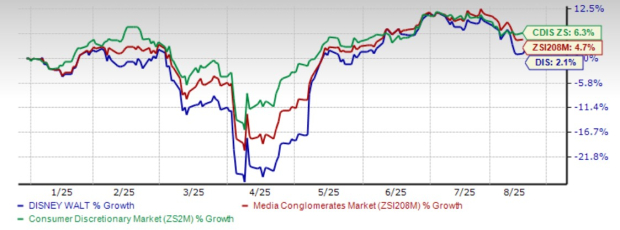

As per Zacks Consensus Estimates, CEG is projected to see EPS growth of 8.88% in 2025 and 25.83% in 2026. The stock is currently trading at a premium with a forward price-to-earnings ratio of 30.73X, compared to the industry average of 21.91X. Over the past year, CEG shares have risen 79.2%, outpacing the industry growth of 67.7%.

CEG holds a Zacks Rank of #3 (Hold), indicating a stable outlook for investors. Other utility companies, such as Vistra (VST) and NextEra Energy (NEE), are also expanding their renewable operations to navigate energy transitions and capitalize on market dynamics.