Innovative Industrial Properties, Inc. (IIPR), a trailblazing real estate investment trust (REIT) focusing on specialized properties leased to reputable, state-licensed operators for their cannabis facilities, is geared up to reveal its fourth-quarter and full-year 2023 outcomes on February 26 after the markets close.

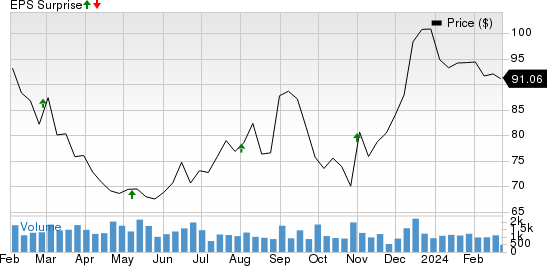

Last quarter, IIPR surprised the market with a 4.57% beat in adjusted funds from operations (FFO) per share, showcasing stronger-than-anticipated revenues. Impressively, over the past four quarters, IIPR consistently exceeded the consensus FFO estimates, boasting an average beat of 7.67%.

The firm’s distinctive appeal arises from its fusion of the burgeoning cannabis industry’s growth potential with the reliability of the real estate sector. As we venture into this analysis, we aim to dissect IIPR’s recent performance and dissect the factors influencing its Q4 and full-year 2023 results.

The Landscape of Influence

IIPR’s Q4 2023 performance is poised to benefit from regulatory transformations in the cannabis realm and the increasing mainstream acceptance of cannabis for medical and recreational use.

The company is projected to gain from rising tenant reimbursements, acquisitions and leases of new properties, as well as additional infrastructure allowances granted to tenants at certain properties, ultimately driving base rent increases.

Nevertheless, persistent inflations in input costs and labor expenses may have impacted overall costs, along with pricing pressures likely denting profitability to a degree.

Anticipated Projections

The Zacks Consensus Estimate forecasts quarterly revenues at $77.25 million, indicating a 9.64% year-over-year surge.

While analysts remain cautious about IIPR’s Q4 undertakings, the FFO per share estimate stands firm at $2.27, suggesting a 7.08% uptick year-over-year. For the full year, the projection for adjusted FFO per share remains steady at $9.08, marking a 7.46% increase from the previous year.

The anticipated 2023 revenue estimate is pinned at $307.6 million, envisioning an 11.3% uplift from the prior year.

Insights from the Figures

Our assessment model refrains from definitively forecasting a significant FFO surprise for IIPR this season. A favorable blend of Earnings ESP and a Zacks Rank #1, 2, or 3 significantly boosts the chances of an FFO beat — which, unfortunately, isn’t the case for IIPR presently.

With a Zacks Rank of 3 and an Earnings ESP of 0.00%, the odds don’t seem aligned for IIPR. For more market insights, explore our innovative Earnings ESP Filter.

A Closing Glance

Our evaluations suggest that Extra Space Storage Inc. (EXR) registers the ideal fusion of factors to possibly unveil a surprise this quarter.

EXR, slated to disclose quarterly figures on February 27, displays an Earnings ESP of +0.70% and holds a Zacks Rank of 3. For a comprehensive list of today’s top Zacks #1 Rank stocks, peek here.

For the latest updates on upcoming earnings announcements, stay up to date with the Zacks Earnings Calendar.

Disclaimer: All earnings-related information presented here pertains to funds from operations (FFO), a widely-used metric for assessing REIT performance.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – grasp the opportunity to explore our top 10 stocks for 2024, endorsed by Zacks Director of Research, Sheraz Mian. From inception in 2012 through November 2023, the Zacks Top 10 Stocks saw a staggering +974.1% growth, nearly tripling the S&P 500’s +340.1% hike. Sheraz has meticulously curated the best 10 stocks for the forthcoming year. Be among the first to unearth these newly-released stocks with vast potential.

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

Innovative Industrial Properties, Inc. (IIPR) : Free Stock Analysis Report

Read the full article on Zacks.com here.

The author’s views and opinions expressed herein do not necessarily align with those of Nasdaq, Inc.