FICO Shares Shine in 2024: Analyzing Growth and Market Position

Fair Issac’s FICO shares have significantly outperformed the Zacks Computer & Technology sector and leading IT Services companies Infosys (INFY) and ServiceNow (NOW) during the year-to-date period.

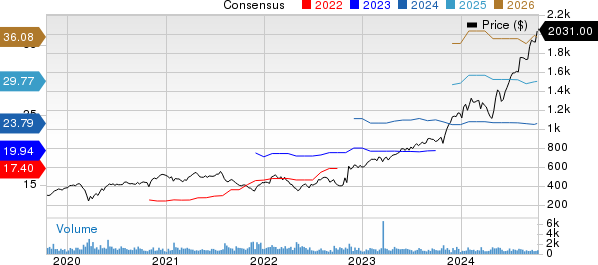

FICO’s stock has skyrocketed 74.5%, while Infosys and ServiceNow’s shares have increased by 24.7% and 32.8%, respectively. Meanwhile, the broader sector has witnessed a growth of 25.5% in the same timeframe.

This impressive stock performance stems from strong results in its Scores and Software segments, which have helped FICO expand its customer base and boost revenue.

In the third quarter of fiscal 2024, FICO saw a revenue increase of 12% year-over-year. Within that, Software revenues rose by 5%, while Scores revenues surged by an impressive 20%.

Strong Demand and Expansion Potential for FICO

FICO benefits from the growing adoption of its FICO Scores, a leading player in the consumer credit scoring sector.

This advantageous position is reinforced by the adoption of FICO Score 10-T for non-GSE mortgages in the third quarter of fiscal 2024, which covers over $126 billion in annual originations and $380 billion in servicing. This development is expected to enhance future revenues through improved credit decision-making and securitization.

The company follows an effective land-and-expand strategy, which has steadily increased its Annual Recurring Revenue (ARR) from its FICO platform’s SaaS offerings. In the latest quarter, platform ARR grew by an impressive 31%, contributing to an overall ARR growth of 10%.

FICO’s international presence is also expanding, with 85% of revenues coming from the Americas, 10% from EMEA, and 5% from Asia-Pacific as of the third quarter of fiscal 2024. This diversification indicates opportunities for growth beyond North and Latin America.

A notable part of FICO’s expansion is its partnership with Cognizant (CTSH), which aims to develop a cloud-based, real-time payment fraud prevention solution utilizing FICO Falcon Fraud Manager. This joint effort focuses on enhancing security measures and optimizing fraud detection for clients in various industries.

The collaboration leverages AI and machine learning technologies to support banks and payment service providers in North America in safeguarding their customers against fraud.

Optimistic Outlook for 2024

FICO’s strong portfolio and expanding clientele suggest a promising growth trajectory as it heads into 2024.

The company anticipates a total revenue of $1.7 billion for the current fiscal year, with non-GAAP earnings projected at $23.16 per share.

The Zacks Consensus Estimate for revenues stands at $1.72 billion, reflecting a year-over-year growth of 13.53%.

Additionally, the consensus estimate for fiscal 2024 earnings is set at $23.79 per share, which has increased by 0.55% over the past 30 days and indicates a 20.66% year-over-year growth.

For the latest EPS estimates and surprises, check Zacks Earnings Calendar.

Investors’ Perspective on FICO Stock

FICO’s robust portfolio and increasing customer base, particularly in its Scores and Software segments, are catalyzing consistent revenue growth and boosting its future potential.

The stock is currently rated as Zacks Rank #2 (Buy) and has a Growth Score of B. For a complete list of Zacks #1 Rank (Strong Buy) stocks, click here.

According to Zacks’ proprietary rating system, stocks with a combination of Zacks Rank #1 or 2 and a Growth Score of A or B present solid investment potential.

Top 7 Stocks for the Upcoming Month

Recently released: Experts have selected 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys, identifying these tickers as “Most Likely for Early Price Pops.”

Since 1988, this exclusive list has more than doubled the market performance with an average annual gain of +23.7%. These carefully selected stocks warrant your immediate attention.

Cognizant Technology Solutions Corporation (CTSH): Free Stock Analysis Report

Infosys (INFY): Free Stock Analysis Report

Fair Isaac Corporation (FICO): Free Stock Analysis Report

ServiceNow, Inc. (NOW): Free Stock Analysis Report

For the original article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.