Fairfax Financial Holdings – A Glimpse into the Company

Fairfax Financial Holdings Limited, (TSX:FFH:CA) is a key player in the property and casualty insurance and reinsurance, and investment management services in the United States, Canada, Asia, and internationally. Led by its founder, Chairman, and CEO, Prem Watsa since 1985, the company is an iconic figure in the Canadian business world, often likened to Warren Buffett and Berkshire Hathaway Inc. (BRK.A). Watsa’s early prediction of the US Subprime crisis in 2006, mentioned in his letter to shareholders, has solidified FFH’s position in the market.

Despite a recent setback with a negative report from Muddy Waters causing a temporary 12.5% dip in shares, FFH’s strong performance has been acknowledged by analysts. As FFH reports its Q4 figures after the market close on February 15th, there is optimism regarding continued profit growth and a positive outlook for the company

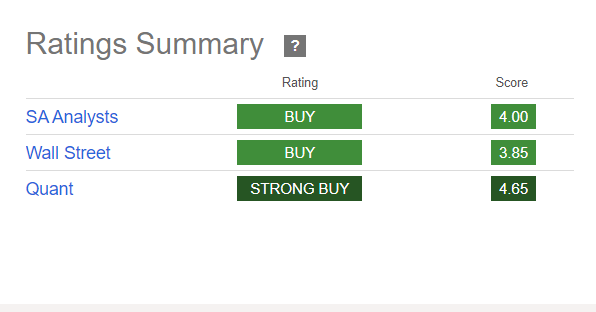

For investors, FFH is worth a hold going into earnings, with expectations of an upgrade post-earnings, based on solid performance and sectoral tailwinds.

The Fairfax Insurance Businesses – A Look into the Key Businesses

Fairfax operates through a range of key businesses that have experienced rapid growth. Over the past 5 years, the company has witnessed a doubling of premiums written, with an average Combined Ratio (CR or COR) of 96%, indicating a solid underwriting profit after costs of 4% of premiums.

The Combined Ratio, a crucial metric in the Property/Casualty Insurance (P&C) industry, reflects FFH’s strong performance compared to the broader US P&C market, which has seen combined ratios over 100% in every segment from 2021-2023. In 2017, the industry last printed a sub-100% combined ratio, making FFH’s achievement significant in this market.

!

Odyssey Re – A Closer Look

Odyssey, a US-based pure play P&C reinsurer, writes 24% of the overall group premiums. The company has demonstrated consistent profitability with a combined ratio of under 100% since 2001. As a wholesale business, selling protection products to insurance companies, reinsurance is a critical tool for managing required capital and volatility, with products such as catastrophe reinsurance being essential for protection against natural disasters.

Reinsurance Industry Insights and Key Players in 2023

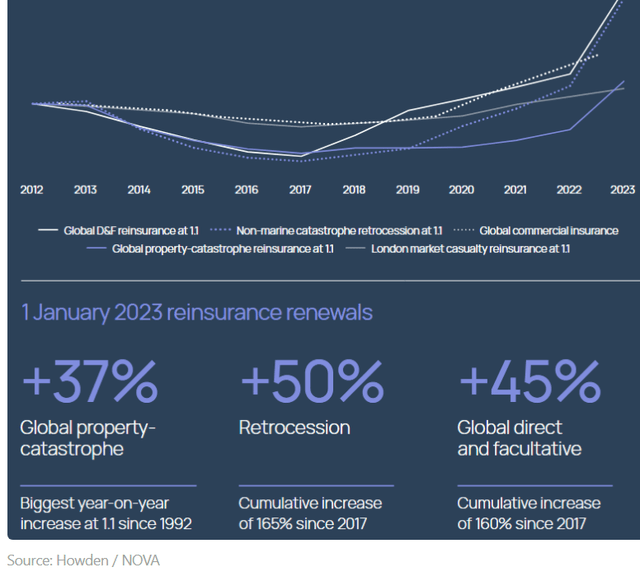

2022 marked a watershed year for the reinsurance industry, driven by the significant impact of catastrophes such as hurricane Ian, which led to losses amounting to $120 billion for the year, as reported by Munich Re. This historical context sets the stage for understanding the subsequent developments and shifts in the industry’s landscape.

New Challenges Faced by Traditional Reinsurers

In the aftermath of the catastrophic events in 2022, the traditional reinsurers experienced substantial challenges. A significant portion of the capital in the industry from Insurance-Linked Securities (ILS) came under stress as the collateral supporting the product was ‘trapped’ due to unpaid claims, and new capital entered the market at a slow pace. Moreover, the spread offered by ILS products did not compensate for the high-risk profile against the backdrop of increased risk-free rates.

Increase in Demand and Impact on Reinsurance Prices

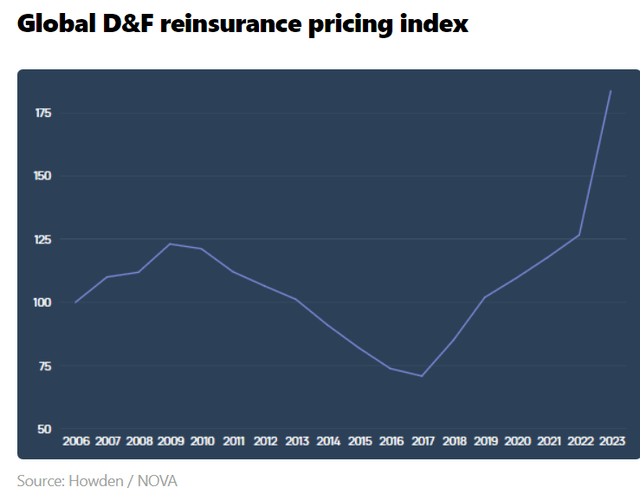

The high rates of inflation in 2023 led to a considerable increase in the demand for reinsurance capital, further reshaping the industry dynamics. As a result, there was a sharp surge in the prices of reinsurance products during the year, as evidenced by the significant price hikes in 2023, marking the most substantial single increase in Catastrophe prices for decades, as depicted in the exhibit by Howden, a leading (Re)insurance broker.

Impact on Reinsurance Renewal Season and Price Trends

Reinsurance contracts, typically negotiated annually as wholesale products to large companies, witnessed a notable influence from the increased prices. Approximately 60% of these contracts were due at the famous ‘Reinsurance renewal season’ on January 1st, with an additional 25-30% renewing mid-year in June/July.

While prices have stabilized to an extent, the 2024 renewals are anticipated to reflect continued increases, aligned with the inflation and loss trends, according to the recent outlook from Hannover Re, which noted an average price hike of 2.3% after adjusting for inflation and loss trends.

As we look ahead, it is essential to recognize the potential impact of these pricing trends on the financial performance of key market players.

Performance and Outlook of Key Reinsurance Players

Allied World Insurance Company (AWAC)

AWAC, as a hybrid insurer and reinsurer, occupies a significant position in the global reinsurance landscape. Its acquisition by FFH in 2017 for $5 billion marked a pivotal moment for the group, constituting 24% of the group premiums.

The company demonstrated robust performance in 2022, with a 91% combined ratio and a 14% year-on-year growth. Operating with 23 offices worldwide and a syndicate at Lloyd’s of London, AWAC offers scale and a proven track record of success to the FFH stable while providing diversification of risk profile.

Crum & Forster

Crum and Forster, representing 17% of FFH, operates as a US-based specialty insurer, predominantly focusing on Accident and Health as well as Excess and Surplus Lines (E&S) insurance – a segment that experienced substantial growth in 2022 due to regulatory dynamics and market pressures.

In light of these favorable conditions, Crum & Forster is anticipated to sustain its growth trajectory and solidify its position with strong margins.

Brit

Operating within the Lloyds of London marketplace, Brit specializes in reinsurance and specialty insurance classes, including Direct and Facultative Property (D&F), contributing 14% of group premiums.

While Brit has historically lagged within the group, reporting an average combined ratio of 102%, the prevailing pricing dynamics are expected to exert a positive influence on its outlook, aligning with the broader pricing trends in the market. Furthermore, recent reports from Lloyds of London indicate a potential boost in profitability, indicating a promising shift for Brit’s performance.

In the midst of these transformative market conditions, investors stand to gain valuable insights from the performance and strategic positioning of these key industry players, providing a clear understanding of the broader implications and opportunities in the reinsurance landscape.

FFH: A Deep Dive into the 2023 Financial Prospects

The financial world is abuzz with the latest developments in the world of insurance, particularly with regard to Fairfax Financial Holdings Limited (FFH). There is no underestimating the immense growth FFH has experienced, boasting an impressive plan for leveraging automation and machine learning to its advantage, and set to produce strong results for the year 2023 based on my observations. Let’s take a closer look at the specifics of this thriving enterprise and what the future holds.

Northbridge Insurance: A Pillar of Stability

Within the FFH enterprise, Northbridge Insurance stands as a stalwart, accounting for 8% of overall premiums and focusing primarily on Canadian commercial lines and specialty insurance segments. While the majority of premiums are generated from emerging markets, Northbridge represents a bedrock of stability within the FFH stable, demonstrating the company’s well-diversified operations.

2023 Results at Q3: A Glimpse into the Success

The third-quarter results of 2023 herald a promising picture for FFH, showcasing a steady 7.5% increase in YTD gross premiums. The combined ratio of 94% is a reassuring sign, particularly as FFH’s internal targets for its insurance units hover below the 95% mark. Furthermore, with a 1% share repurchase in 2023 and an implied Return On Equity of 20%, the business is on a remarkable trajectory of growth and success, culminating in a recent 50% dividend increase. Overall, the Q3 results spell out a record performance for FFH, setting a solid foundation for what lies ahead.

Seeking Alpha analysts have expressed bullish sentiments, while Quant Factor Grades underscore the strength of the company, with robust marks across the board. These indicators, combined with the evident market momentum and strong performance in recent years, bode well for FFH’s upward trajectory.

Valuation: A Promising Proposition

In comparison to industry peers, FFH’s valuation remains compelling, particularly in terms of its price/earnings basis. Even though the price to book value has experienced a surge in recent months, the narrow price to book range coupled with the notably low P/E following the recent drop presents an appealing investment proposition. As an entity that has substantially expanded since 2017, with a track record of consistent profitability, FFH stands out as an attractive option for investors seeking long-term value.

Moreover, as the commercial property and casualty insurance industry emerges from a downturn post-COVID, FFH’s low P/E of 8.3 offers a compelling entry point, especially considering the company’s stellar growth and sustained profitability. These positive market conditions are anticipated to persist into 2024, solidifying FFH’s position as an intriguing investment opportunity.

The Bear Case: Navigating through the Challenges

Despite the prevailing optimism, a bear case recently surfaced with short seller Muddy Waters (MW) unveiling a short position on FFH. Allegations of accounting manipulation and overstated book value have cast a shadow over the company’s otherwise promising outlook, prompting a closer examination of the potential risks and challenges that FFH may face.

MW’s contentions center around aggressive book carries of privately held assets, raising concerns about the accuracy of FFH’s reported book value. The specific examples cited, such as the valuation of Recipe, a privately held asset, has intensified scrutiny over FFH’s valuation practices, casting a pall over the company’s financial standing.

Decoding the Intricacies of FFH’s Run-off Liabilities and IFRS17 Implementation

As we delve into the strategic maneuvers of Fairfax Financial Holdings (FFH), a deep look into the run-off liabilities being carried on its balance sheet reveals intriguing patterns. In the world of P&C insurers, the use of run-off transfers has become a common strategy to streamline balance sheets and facilitate the funding of new business endeavors.

The Nuances of Run-off Transfers

These transfers typically take the form of Loss Portfolio Transfers, which involve the complete shift of insurance liabilities between companies, or Adverse Development Covers, which set a limit on the potential downside of reserve inadequacy.

Guided by strict accounting standards, such as FAS 113 under US GAAP and its IFRS17 equivalent, these transactions are meticulously designed to ensure genuine risk transfer and prevent manipulation for accounting purposes.

Unpacking the Complexity of IFRS17

The shift to IFRS17 accounting standards has stirred discussions and debates, especially regarding its implementation and implications for insurance companies across the globe, including in Europe, Canada, and the United Kingdom.

This significant accounting transition has now become the reporting standard for Canadian P&C insurers, effective from January 1, 2023.

The incorporation of IFRS17 revolves around the formulaic derivation of capital and margin creation from the profile of insurance liabilities, with explicit recognition of the embedded value of the business. It emphasizes the thorough assessment of the value of the business through a ‘net present value’ approach tailored to each portfolio’s underlying modeling assumptions.

Understandably, the diverse impacts of IFRS17 on different insurance companies, including reinsurers, personal lines insurers, and commercial insurers, underscore the varying margin profiles and duration of liabilities.

Navigating Governance and Accounting Concerns

Beyond the accounting nuances, questions loom over governance, with particular focus on the FFH auditor’s enduring tenure and the composition of its Board of Directors. The presence of lengthy audit tenures and familial connections to the founder warrant scrutiny.

FFH Responds

In response to the raised concerns, FFH has promptly issued a straightforward denial of any accounting irregularities. While highlighting robust Q3 earnings and setting the stage for the imminent release of Q4 earnings, the response aims to reassure shareholders and assert the company’s financial stability.

However, the absence of forward-looking insights or significant company-share purchases has left some investors seeking more compelling assurances given the proximity to the earnings release.

An Independent Perspective

Amid the robust discourse, an independent view emerges, acknowledging the surfaced queries while advocating for a balanced assessment of FFH’s standing. Emphasizing the stringent regulatory oversight from Canada’s financial services regulator and the standardized accounting practices under IFRS17, this viewpoint assuages immediate concerns regarding FFH’s governance and accounting integrity.

Validating the scrutiny, there are reservations surrounding the valuation of privately held assets, inviting measured skepticism about potential overvaluation impacting book value calculations. Nonetheless, the argument contends that the cumulative impact remains insufficient to substantiate aggressive short positions.

Risks to the Thesis

While the spotlight remains on accounting integrity, peripheral risks loom on the horizon, encompassing asset risk, climate and catastrophe risk, inflation risk, regulatory risk, and reserving risk. The latter is somewhat mitigated by proactive run-off management.

In Summary

- FFH’s valuation surge notwithstanding, the fundamental core of the business presents a robust and expanding outlook.

- Underlying business segments bask in the glow of multi-year record positive earnings tailwinds.

- Despite unveiled queries, the short thesis fails to fully encompass the inherent strength of FFH’s business foundation.

- Amid the discord, FFH’s accounting and transaction practices, when dissected by experts, lack alarming anomalies.

- There seems to be no compelling reason for investors to spiral into panic as the company approaches its earnings release.

- For now, FFH merits a hold position, paving the way for Q4 earnings and a comprehensive rebuttal to the short thesis.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.