FDA Accepts Sanofi and Regeneron’s Dupixent Application for Chronic Urticaria

Sanofi SNY and its partner Regeneron REGN have announced that the FDA has accepted their resubmitted supplemental biologics license application (sBLA) for Dupixent. This application seeks approval for treating chronic spontaneous urticaria (CSU).

The sBLA is aimed at adults and adolescents aged 12 and older who do not find relief from existing treatments such as H1 antihistamines. A decision from the FDA is anticipated by April 18, 2025.

The FDA previously issued a complete response letter (CRL) in October 2022, citing the need for additional information regarding the first sBLA for Dupixent in CSU.

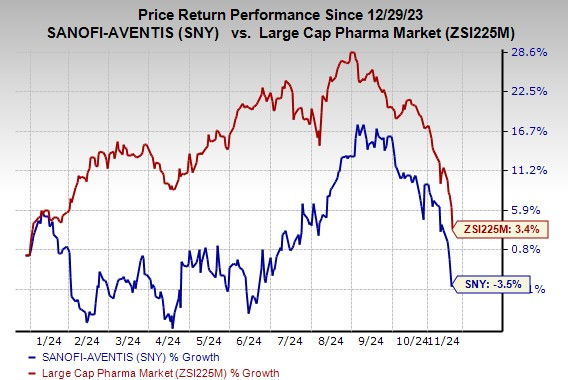

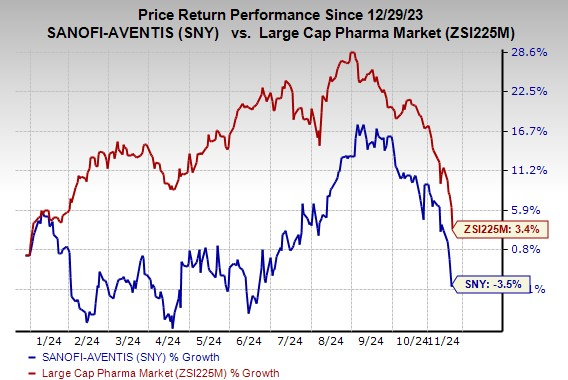

Sanofi’s stock has faced a 3.5% decline this year, in contrast to a 3.4% rise in the overall industry.

Image Source: Zacks Investment Research

CSU is an inflammatory skin condition linked to type 2 inflammation, leading to sudden hives and swelling that often respond poorly to antihistamines. The latest sBLA submission for Dupixent is backed by new data from the pivotal LIBERTY-CUPID Study C, involving patients with uncontrolled CSU on standard-care antihistamines. Results showed Dupixent effectively reduced itch and hive activity. Previously, the original sBLA was supported by positive findings from two other pivotal studies, LIBERTY-CUPID Studies A and B.

Dupixent already has approval for CSU in Japan and is under review in the EU.

Dupixent: A Key Player for Sanofi and Regeneron

Dupixent has been approved in multiple countries, including the U.S. and EU, for six type II inflammatory diseases, such as severe chronic rhinosinusitis with nasal polyps, severe asthma, moderate-to-severe atopic dermatitis, eosinophilic esophagitis, prurigo nodularis, and chronic obstructive pulmonary disease.

Sanofi and Regeneron collaborate in marketing Dupixent. Sanofi tracks global sales while Regeneron records its share of profits or losses from these sales.

Dupixent serves as a strong revenue contributor for both firms, reflecting high demand. In the first nine months of 2024, Sanofi generated €9.6 billion in global product sales from Dupixent, marking a 25.9% growth at constant exchange rates. The company forecasts over €13 billion in sales for Dupixent this year.

Regeneron, on the other hand, recorded collaboration revenues of $3.32 billion from Dupixent during the same period, a year-over-year increase of 18.2%.

Sanofi’s Current Standing and Peer Insights

Sanofi holds a Zacks Rank #3 (Hold) at present.

Analyzing Sanofi’s Performance

Sanofi price-consensus-chart | Sanofi Quote

Among other notable pharmaceutical companies, Gilead GILD and Pfizer PFE both hold a Zacks Rank #2 (Buy). You can find the full list of Zacks #1 Rank (Strong Buy) stocks here.

Gilead’s earnings estimates for 2024 have climbed from $3.77 to $4.28 per share in the last 60 days. For 2025, estimates increased from $7.27 to $7.40 per share. Year-to-date, Gilead’s stock has grown by 9.2%.

Gilead has surpassed earnings estimates in three of its last four quarters, yielding an average surprise of 15.46%.

Pfizer’s 2024 earnings estimates have shifted from $2.66 to $2.88 per share in the last two months. For 2025, those estimates improved from $2.86 to $2.92 per share. However, Pfizer’s stock has decreased by 13.9% so far this year.

Pfizer has consistently exceeded earnings projections in each of the last four quarters, with an average surprise of 74.50%.

Unlock Access to Comprehensive Recommendations

Exclusive Opportunity

Some years ago, we introduced an exclusive offer allowing members to gain 30-day access to all our stock picks for just $1. No further obligations required.

Many have taken advantage, while others were hesitant, wondering if there was a catch. Our intent is simple: to let you explore our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more. These services collectively closed 228 successful positions with impressive gains last year.

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Sanofi (SNY): Free Stock Analysis Report

Pfizer Inc. (PFE): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Read the full article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.