Sanofi’s Tolebrutinib Receives FDA Priority Review for MS Treatment

Sanofi (SNY) announced that the FDA has accepted its regulatory filing for approval of the investigational BTK inhibitor tolebrutinib. This drug aims to treat non-relapsing secondary progressive multiple sclerosis (nrSPMS) and slow disability accumulation independent of relapse activity in adults.

The FDA’s decision to grant priority review has reduced the review period by four months. A final decision on the approval is expected by September 28, 2025.

Clinical Support and Significance

This regulatory filing is backed by data from three late-stage studies: one study (HERCULES) focused on nrSPMS, while the other two (GEMINI 1 and 2) involved relapsing multiple sclerosis (RMS). Results from HERCULES indicated that patients treated with tolebrutinib experienced a delay in the onset of six-month confirmed disability progression compared to those receiving a placebo. In addition, data from GEMINI 1 and 2 showed that tolebrutinib delayed time to onset of six-month disability worsening versus Aubagio (teriflunomide). A similar filing is also under review by the EMA, supported by the same data.

According to Sanofi, these results establish tolebrutinib as the first brain-penetrant BTK inhibitor targeting both MS indications. If approved, it will also be the first therapy specifically designed to tackle smoldering neuroinflammation, a significant factor contributing to disability accumulation in MS. This development offers a potential solution to a considerable unmet need in the treatment landscape of MS.

Multiple sclerosis is a chronic neurodegenerative condition leading to progressive disability. Currently, available therapies primarily address peripheral inflammation, leaving a gap in treatments for nrSPMS, as no therapies have received approval for this condition to date.

SNY Stock Performance Overview

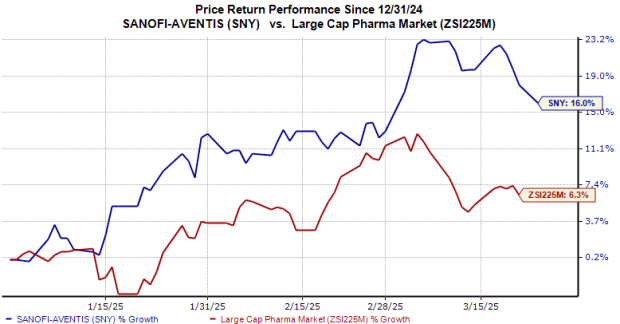

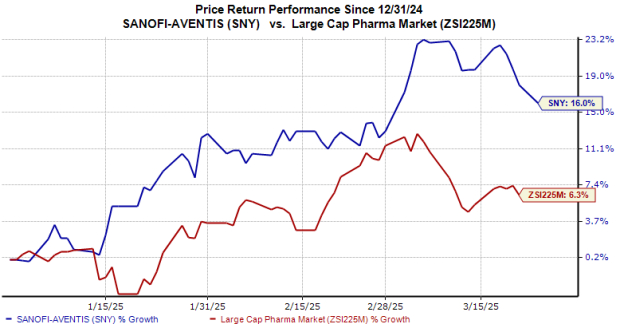

Year-to-date, Sanofi’s shares have increased by 16%, outpacing the industry’s growth of 6%.

Image Source: Zacks Investment Research

Ongoing Research with Tolebrutinib

In addition to the nrSPMS and RMS applications, Sanofi is investigating tolebrutinib in the phase III PERSEUS study for patients with primary progressive MS, with results anticipated in the latter half of 2025.

Tolebrutinib was incorporated into Sanofi’s portfolio following the acquisition of Principia in 2020. However, in 2022, the FDA imposed a partial clinical hold on phase III studies for tolebrutinib in MS and myasthenia gravis (MG) indications due to identified cases of drug-induced liver injury in some participants. Consequently, the MG trials were discontinued after a thorough assessment of the competitive treatment landscape.

Current Market Standing

Sanofi currently holds a Zacks Rank #3 (Hold).

Sanofi Stock Price

Sanofi price | Sanofi Quote

Other Noteworthy Biotech Stocks

Several stocks in the biotech sector carry favorable ratings, including ANI Pharmaceuticals (ANIP), CytomX Therapeutics (CTMX), and 89bio (ETNB). Both ANIP and CTMX currently hold Zacks Rank #1 (Strong Buy), while ETNB is rated #2 (Buy). You can explore the full list of today’s Zacks #1 Rank stocks here.

Over the past 60 days, ANI Pharmaceuticals’ 2025 earnings per share (EPS) estimates have risen from $5.54 to $6.35. EPS estimates for 2026 have also increased from $6.75 to $7.21 in that same period. Year-to-date, ANIP shares have grown by over 19%.

ANI Pharmaceuticals has also consistently outperformed earnings estimates, with an average surprise of 17.32% over the last four quarters.

CytomX Therapeutics has seen its 2025 EPS estimates improve from a loss of 31 cents to earnings of 25 cents in the last 60 days. Meanwhile, the estimates for 2026 have tightened from a loss of 65 cents to 31 cents. Year-to-date, shares of CytomX have declined by 35%.

In the past four quarters, CTMX delivered earnings above estimates three times and fell short once, resulting in an average surprise of 180.70%.

For 89bio, loss per share estimates for 2025 have narrowed from $3.19 to $1.98 in the past 60 days, with 2026 estimates improving from $2.49 to $2.15. Year-to-date, ETNB shares have increased by 17%.

89bio has seen mixed results in earnings, missing estimates in three of the last four quarters, but achieved a beat once, leading to an average negative surprise of 46.18%.

(This article has been reissued to correct an error. The original article published on March 25, 2025, should no longer be referenced.)

Zacks Identifies Top Semiconductor Stock

It’s just 1/9,000th the size of NVIDIA, which has surged over 800% since our recommendation. While NVIDIA remains a strong investment, our newly identified top chip stock presents significant growth potential.

With robust earnings growth and a widening customer base, it’s positioned to capitalize on the growing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is projected to jump from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock for Free >>

Sanofi (SNY) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

89BIO (ETNB) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.