Microsoft Corporation (MSFT) experienced its worst single-day drop since March 2020 on February 6, 2026, despite exceeding Wall Street earnings estimates. The decline follows a significant $37.5 billion in capital expenditures on AI data centers—a 66% increase year-over-year—raising investor concerns about slowing cloud business and reliance on OpenAI. This negative sentiment among AI stocks may impact the broader market in the coming weeks.

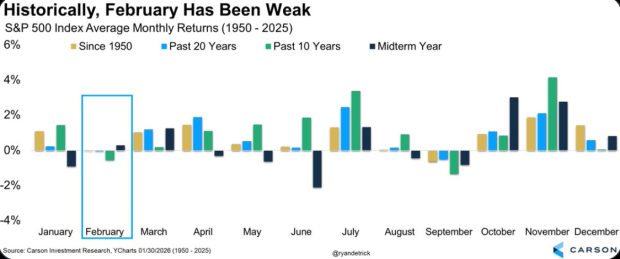

In the commodity market, silver has shown signs of a potential downturn after a remarkable rise, with indicators like record trading volumes and significant deviations from the 200-day moving average alerting investors. Historically, such “blow-off tops” have preceded market corrections, often resulting in a 10% decline in the S&P 500. February, known for its bearish trends, often brings corrections in mid-term election years, according to Carson Research.

Additionally, the AAII Sentiment survey indicates that individual investors are overwhelmingly bullish, which typically serves as a contrarian indicator. Observations point to the likelihood of a consolidation period ahead, despite a long-term positive outlook for 2026 driven by favorable economic conditions and advancements in AI.