Top Stock Picks for February: Invest in These AI and E-Commerce Leaders

Every month, I review my portfolio to find the best stocks to buy. Currently, major AI companies are seeing their stocks drop, which presents a buying opportunity for investors. Here are my four must-have stocks for February, featuring leaders in the AI sector along with a standout e-commerce company that appears undervalued.

Start Your Mornings Smarter! Get the latest Breakfast news in your inbox every market day. Sign Up For Free »

Key Players in AI: Taiwan Semiconductor Manufacturing and Nvidia

Recently, DeepSeek surprised investors by claiming it trained an AI model, rivalling ChatGPT, for under $6 million. This announcement affected the stock prices of Taiwan Semiconductor Manufacturing (NYSE: TSM) and Nvidia (NASDAQ: NVDA), two companies that thrive on the growth of AI technologies.

Some believe less computing power is needed now that AI models are more efficient. However, this assumption could be misleading. U.S. companies continue to invest heavily in AI, and these trends remain unchanged despite DeepSeek’s claims. The Jevons paradox also suggests that increased efficiency leads to greater consumption as costs decrease.

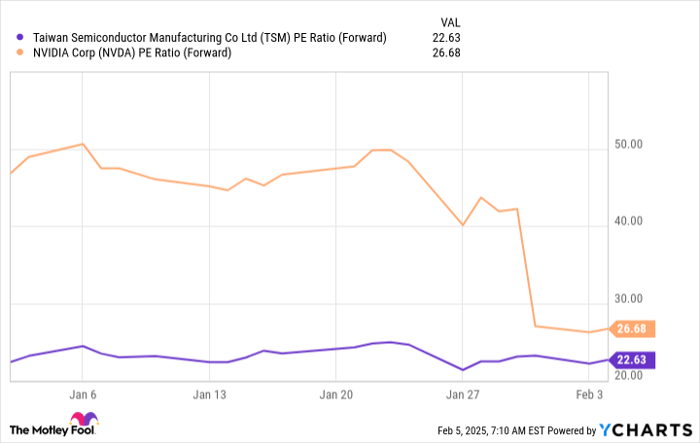

Thus, both Nvidia and Taiwan Semi are expected to thrive in the long run, and their current price dip represents a potential buying opportunity. Both stocks are now trading at attractive forward price-to-earnings ratios.

TSM PE Ratio (Forward) data by YCharts

Considering that the S&P 500 is trading at 22.3 times forward earnings, Nvidia and Taiwan Semi appear to be great value buys, especially given the strong growth they are projected to achieve.

A Leader in AI & Advertising: Meta Platforms

Meta Platforms (NASDAQ: META) is a powerful business that often goes underestimated. With its popular platforms like Facebook, Instagram, Threads, WhatsApp, and Messenger, it generated $46.8 billion in advertising revenue in Q4, marking a 21% increase from last year.

Meta’s Family of Apps division also boasted a remarkable 60% operating margin during the same period. This level of profitability is rare and reinforces my belief that Meta is a top-tier business.

While investing profits into artificial intelligence, virtual reality, and augmented reality, the company aims to secure another revenue stream. Even though these ventures haven’t yielded financial returns yet, they hold potential for future success.

Moreover, with the stock trading at 28 times forward earnings, investing now makes financial sense.

E-Commerce Standout: MercadoLibre

MercadoLibre (NASDAQ: MELI) is a leading e-commerce platform in Latin America that may not be familiar to many investors. It combines a strong e-commerce network with a growing fintech strategy, drawing comparisons to PayPal and Amazon.

Currently, MercadoLibre faces temporary losses in its credit division that are impacting overall profits. However, this is expected to improve over time.

Despite the challenges, MercadoLibre’s revenue continues to surge, increasing by 35% year over year. With a price that equates to only 16 times free cash flow, the stock appears exceptionally affordable given its growth trajectory.

MELI Price to Free Cash Flow data by YCharts

Considering its substantial growth and market dominance, MercadoLibre is a stock worth accumulating.

Seize This Second Chance for Investment Opportunities

Have you ever felt like you missed out on investing in successful stocks? This is your chance to reconsider.

Our team occasionally identifies “Double Down” stocks—those poised for remarkable growth. If you’ve hesitated to invest previously, now may be the ideal moment to act. The statistics support this urgency:

- Nvidia: Investing $1,000 when we doubled down in 2009 would now be worth $333,669!*

- Apple: Investing $1,000 in 2008 would yield $44,168!*

- Netflix: Investing $1,000 back in 2004 would be valued at $547,748!*

Right now, we are highlighting “Double Down” alerts for three exceptional companies—don’t miss this rare opportunity.

Learn more »

*Stock Advisor returns as of February 3, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon, MercadoLibre, Nvidia, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Amazon, MercadoLibre, Meta Platforms, Nvidia, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short March 2025 $85 calls on PayPal. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.