“`html

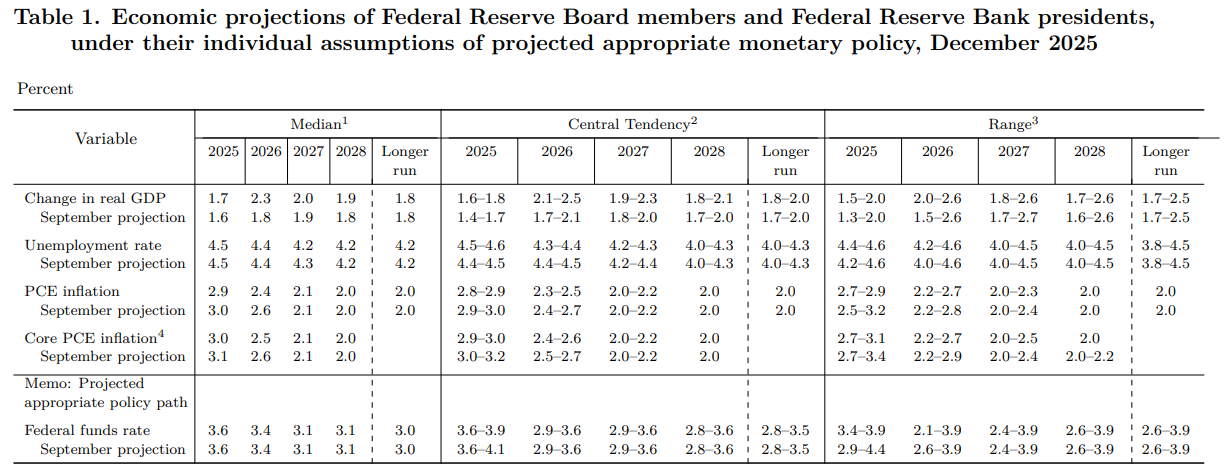

The Federal Reserve has removed itself as a barrier to rising stock prices after a decision on a quarter-point rate cut on Wednesday, signaling a potential rally in equities into the end of the year. Markets reacted positively, with the Fed’s dovish economic projections indicating a soft landing, raising GDP forecasts while lowering inflation expectations.

The Fed’s update revealed divisions within its ranks regarding future rate cuts, suggesting increasing influence from members advocating for further reductions. With the current leadership approaching changes and a robust demand for AI technologies boosting corporate performance, analysts speculate that conditions are ripe for a year-end stock market surge.

Recent government investments further fueled stock gains, exemplified by MP Materials soaring 50% in a day after federal purchases. As the Fed paves the way for lower rates amidst a thriving AI sector, expectations grow that stocks will maintain upward momentum.

“`