Unpacking the Fed’s Policy Paradigm Shift

From maneuvering through supercore measures to embracing mainstream indicators, the U.S. Federal Reserve (Fed) signals a strategic pivot from reactive adjustments to proactive economic steering. Imagine driving without the burden of peering endlessly into the rearview mirror; the Fed now gazes ahead through the windshield.

Implications for the U.S. Economy

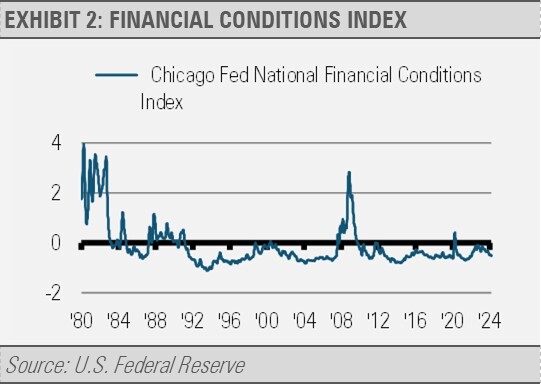

The revamped focus on mainstream inflation metrics such as the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) spells promising news for the U.S. economy. By embracing these indicators, the Fed aims to calibrate its policy maneuvers to navigate potential economic challenges while preempting inflationary forces.

[wce_code id=192]

The Powell Pivot and its Ripple Effect

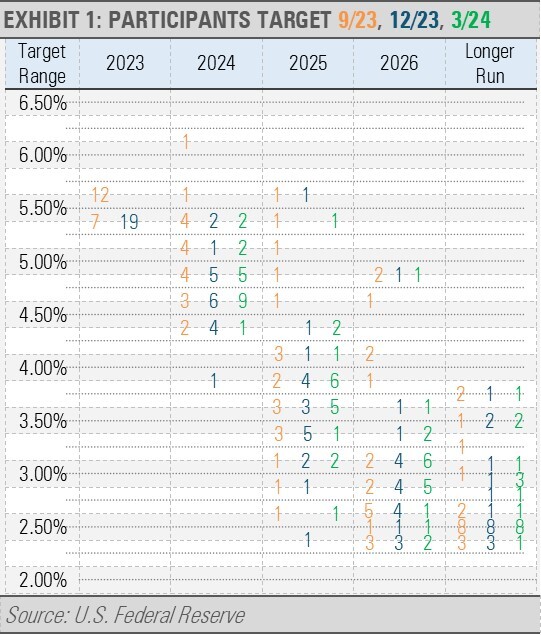

Last year saw the introduction of the Powell Pivot, spearheaded by Fed Chairman Jerome Powell. This strategic shift involves anticipating short-term interest rate adjustments before the inflation target of 2% is reached. The Fed’s recent announcements reaffirm its commitment to reducing interest rates by 0.75% in the current year.

Staying the Course: Fed’s Strategic Continuity

Building upon the Powell Pivot, the recent policy pronouncements by the Fed underscore a consistent stance towards interest rate adjustments. Despite slight upticks in inflation and GDP growth forecasts, the Fed remains committed to its monetary policy objectives, marking a departure from its erstwhile fixation on supercore inflation benchmarks.

A Roadmap for Economic Resilience

By embracing a forward-looking approach, the Fed signals its readiness to navigate the economic landscape proactively. The shift from relying on historical data to anticipate future trends signifies a move towards ensuring economic stability and averting recessionary pressures, all while keeping inflationary forces in check.

For more news, information, and strategy, visit the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.