Bloomberg/Bloomberg via Getty Images

“There’s a meaningful chance — maybe it’s 15% — that the [Federal Reserve’s] next move is going to be upwards in rates, not downwards,” opines former Treasury Secretary Lawrence Summers. This sentiment was shared in an interview on Friday, citing a number of “disturbing” inflation pressures.

Contradicting market opinion, the central bank’s next interest-rate decision is on March 20, with an 89.5% chance that the policy-setting Federal Open Market Committee will keep its benchmark lending rate at the current 5.25%-5.50% target range, according to CME’s FedWatch tool. Similarly, for the March meeting, there’s a 65.3% probability that the FOMC will hold rates steady. The first rate reduction is expected to be implemented at the June 12 gathering.

Reflecting on May projections, Summers believes that a rate cut is “odds-off at this point. And probably should be odds-off,” he told Bloomberg Television. The latest batch of inflation data showed that consumer and producer prices both rose hotter than expected in January.

Acknowledging the erroneous prognostication of economists who anticipated housing costs, the largest component behind inflation, to become a substantial deflationary factor overall, Summers explained that this anticipation has yet to materialize.

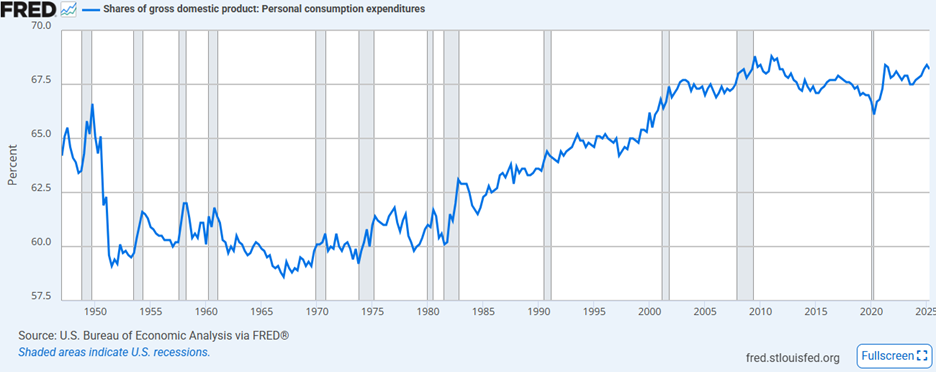

Another “disturbing indication” is core services prices excluding housing, which have seen upward pressure on higher wages. In reference to that measure, which strips out food and energy costs, “it sure looks like super-core was explosive in January,” comments Summers, as quoted by Bloomberg.

“The assumption that inflation was headed down to 2% in a tranquil, healthy, real economy has certainly been called into question by these data,” he adds.