FedEx (FDX) reported a 12% increase in Q4 earnings to $6.07 per share, surpassing estimates of $5.93, as sales reached $22.22 billion, exceeding expectations of $21.73 billion. However, the stock fell 3% after the report, attributed to the company’s decision not to provide guidance for the upcoming fiscal year amid global demand volatility and uncertainty around U.S.-China trade policies. UPS (UPS) shares also dipped 1% in response.

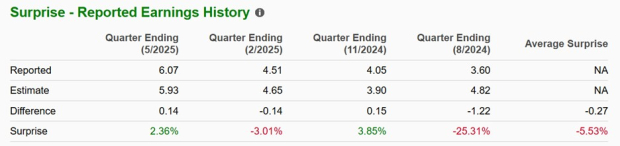

For Q2, UPS is projected to see sales decline 4% to $20.84 billion while EPS is expected to drop 12% to $1.57. In contrast, FedEx has missed earnings expectations in two of its last four quarters, with an average EPS surprise of -5.53%. Despite both companies facing tariff headwinds and being down 20% this year, FedEx boasts a five-year total return of +86% compared to UPS’s +11%.

FedEx’s current P/E ratio stands at 11.7X, while UPS’s is 14.2X, both below the S&P 500’s average of 23.5X. UPS offers a higher dividend yield of 6.52% compared to FedEx’s 2.41%. Both stocks hold a Zacks Rank #3 (Hold), suggesting potential value but acknowledging the risk of ongoing challenges.