Federal Reserve’s Dovish Stance Encourages Stock Market Recovery

Thank you, Mr. Jerome Powell. This week, U.S. Federal Reserve Board Chair Jerome Powell reassured investors that the central bank stands ready to support the U.S. economy with potential rate cuts if necessary. This announcement effectively halted the recent market downturn.

This provided a clear signal for investors to buy stocks.

For the past month, investors have felt jittery since U.S. President Donald Trump initiated a trade war against the country’s largest trading partners. Wall Street’s anxiety over the economic implications of these tariffs led to a steady decline in stock prices.

The rhetoric from the White House only heightened fears, as Trump and his administration suggested they were willing to endure short-term economic pain—potentially even a recession—to achieve their long-term objectives.

This situation understandably made investors nervous.

However, Powell and the Federal Reserve alleviated those concerns, signaling to Wall Street: “Don’t worry – we’ve got your back.”

This dovish stance suggests that it may be time to act and seize the market’s dip.

Market Responses to Dovish Fed Signals

Leading up to yesterday’s announcement, many were concerned that the Federal Reserve might take a hawkish turn.

Since the last communication from the Fed, there have been several developments, including tariffs, federal spending cuts, and increased policy uncertainty, that posed risks to inflation and economic growth. A hawkish response from the Fed could have signaled higher inflation expectations and lower growth, potentially limiting rate cut forecasts.

However, that was not the case.

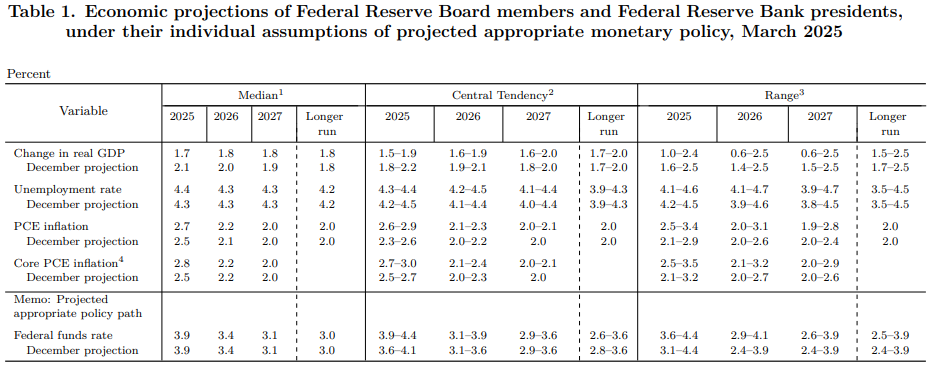

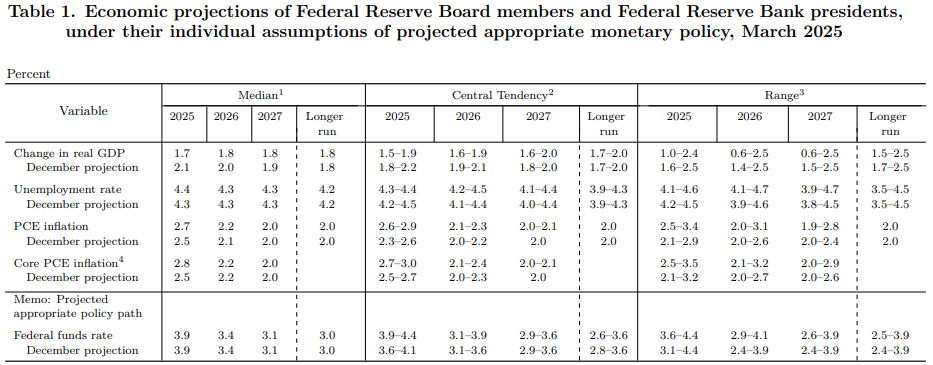

The Fed retained its economic forecasts for 2025, 2026, and 2027, making only minor adjustments to its growth and inflation outlook. Importantly, the Fed maintained its prediction of two rate cuts for this year.

During the press conference following the meeting, Powell emphasized a generally dovish outlook. He conveyed confidence that the economy would remain robust despite ongoing policy changes, but reassured that the Fed is ready to intervene if conditions worsen.

Fed’s Commitment to Economic Support

This message from the Fed is significant.

Wall Street needed assurance that if the global trade war escalates and the U.S. economy shows signs of recession, there would be support to stabilize the situation.

The White House has indicated a preference for enduring temporary hardships for future gains.

In contrast, the Fed has signaled its willingness to intervene proactively. It provided guidance for additional rate cuts this year and pointed out that economic risks have shifted from inflation to growth.

Currently, the Federal Funds rate sits at 4.25%. This gives the central bank ample room for up to 17 rate cuts to stimulate the economy should a slowdown occur.

This prospect is reassuring for investors. The Fed possesses considerable tools to mitigate economic downturns, and their recent statements confirm a readiness to act as needed.

This clarity has prompted investors to enter the market and purchase stocks at reduced prices.

Indeed, here’s what has unfolded as a result:

Recent Stock Market Performance

Stocks have experienced a positive rally over the last two days, climbing over 3% from their recent lows. The S&P 500 has regained its critical 250-day moving average, suggesting that the most severe phase of this selloff may be behind us.

Stocks Recover as the Fed Maintains Dovish Stance: A Prime Buying Opportunity

Current market conditions suggest a rebound might be underway, despite recent stock downturns. We concur with those who believe this is not the end of a bull market, but rather a typical market pullback. Recent sell-offs led stock prices to stabilize just above the 250-day moving average, setting the stage for recovery fueled by a dovish Federal Reserve policy.

This indicates that the recent stock market crash could be closing, presenting fertile ground for a significant bounce in share prices. In other words, it’s time to buy the dip.

Identifying Prime Investment Opportunities

With this recovery in mind, investors may wonder where to seek the best opportunities. Our focus is firmly on artificial intelligence (AI). We posit that AI represents the most significant technological shift in the last thirty years. This wave has already yielded impressive returns, with investments in Palantir (PLTR) generating gains nearing 990% and Nvidia (NVDA) returning approximately 400% over the last two years. Moreover, the potential for growth remains vast.

However, one challenge is that the broader AI market is becoming increasingly competitive. To navigate this crowded space, we have been exploring the next big breakthrough, which we describe as AI 2.0—a development that has the potential to surpass the current AI boom.

Looking Forward: The Future of AI

We invite you to uncover the next generation of AI that may yield even greater profit potential than today’s leading technology firms.

On the date of publication, Luke Lango did not have any positions, either directly or indirectly, in the securities mentioned in this article.

P.S. For ongoing updates and insights into market trends, consider reviewing Luke’s latest analyses available through our Daily Notes. You can find the most recent issues on the Innovation Investor or Early Stage Investor platforms.