Analyzing Analyst Targets: FENY ETF Implied Price Upside

At ETF Channel, we analyzed the underlying holdings of various ETFs in our coverage universe. We compared the current trading price of each holding with the average analyst’s 12-month forward target price. From this analysis, we calculated the weighted average implied target price for each ETF. For the Fidelity MSCI Energy Index ETF (Symbol: FENY), the implied target price derived from its holdings stands at $29.59 per unit.

Currently, with FENY trading around $24.01 per unit, analysts predict a potential upside of 23.25%. This figure is based on the average target prices of the ETF’s underlying securities. Among FENY’s top holdings, three companies stand out for their notable upside potential: NextDecade Corp (Symbol: NEXT), Granite Ridge Resources Inc (Symbol: GRNT), and Kinetik Holdings Inc (Symbol: KNTK).

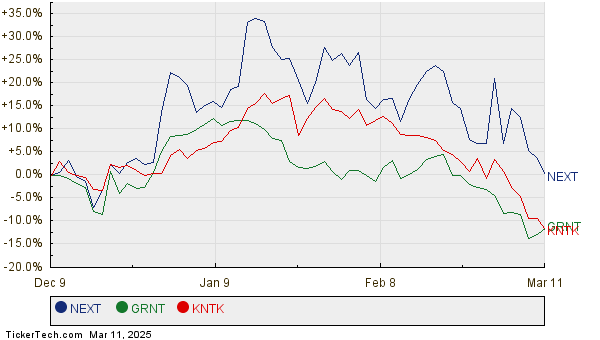

NextDecade Corp recently traded at $6.75 per share, with analysts projecting an average target of $11.33 per share—an increase of 67.90%. Similarly, Granite Ridge Resources is currently valued at $5.44, but analysts expect it to reach a target price of $7.56, indicating 38.97% upside. Lastly, Kinetik Holdings has a recent price of $49.51, yet analysts expect it to achieve a target price of $62.00, representing a 25.23% increase. Below is a twelve-month price history chart that illustrates the stock performance of NEXT, GRNT, and KNTK:

Here’s a summary table of the current analyst target prices for these holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Energy Index ETF | FENY | $24.01 | $29.59 | 23.25% |

| NextDecade Corp | NEXT | $6.75 | $11.33 | 67.90% |

| Granite Ridge Resources Inc | GRNT | $5.44 | $7.56 | 38.97% |

| Kinetik Holdings Inc | KNTK | $49.51 | $62.00 | 25.23% |

Investors may wonder if analysts are justified in their targets or if they are being overly optimistic regarding where these stocks might be in 12 months. Are these target prices based on sound valuation models, or do they reflect outdated perspectives on recent developments in the industry? High target prices compared to stock trading prices can indicate future optimism, but they may also herald potential target price downgrades if their current evaluations no longer hold. These questions warrant further research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• LITE Videos

• Top Ten Hedge Funds Holding WPP

• Funds Holding BITU

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.