On February 15, 2024, F&G Annuities & Life declared a regular quarterly dividend of $0.21 per share ($0.84 annualized), consistent with its prior dividend payment.

To be eligible for the dividend, shares must be acquired before the ex-dividend date of March 14, 2024. Shareholders of record as of March 15, 2024, will receive the payment on March 29, 2024.

At the current share price of $44.57, the stock’s dividend yield is 1.88%. A retrospective analysis of five years’ worth of data indicates an average dividend yield of 3.08%, with the lowest at 1.31% and the highest at 5.06%. The standard deviation of yields is 1.07 (n=52). Importantly, the current dividend yield is 1.11 standard deviations below the historical average.

Furthermore, the company’s dividend payout ratio is -1.14. An explanatory note about the payout ratio follows, with a focus on the health of dividend payments, particularly in relation to growth prospects.

The company boasts a 3-year dividend growth rate of 20.00%, signifying its commitment to increasing dividends over time.

Ownership Trends and Analyst Forecasts

F&G Annuities & Life counts 376 funds or institutions reporting positions in the company, indicating a slight decrease in the last quarter. The average portfolio weight of all funds dedicated to FG has increased to 0.28%, with a total of 15,751K shares owned by institutions, representing a 4.72% increase in the last three months.

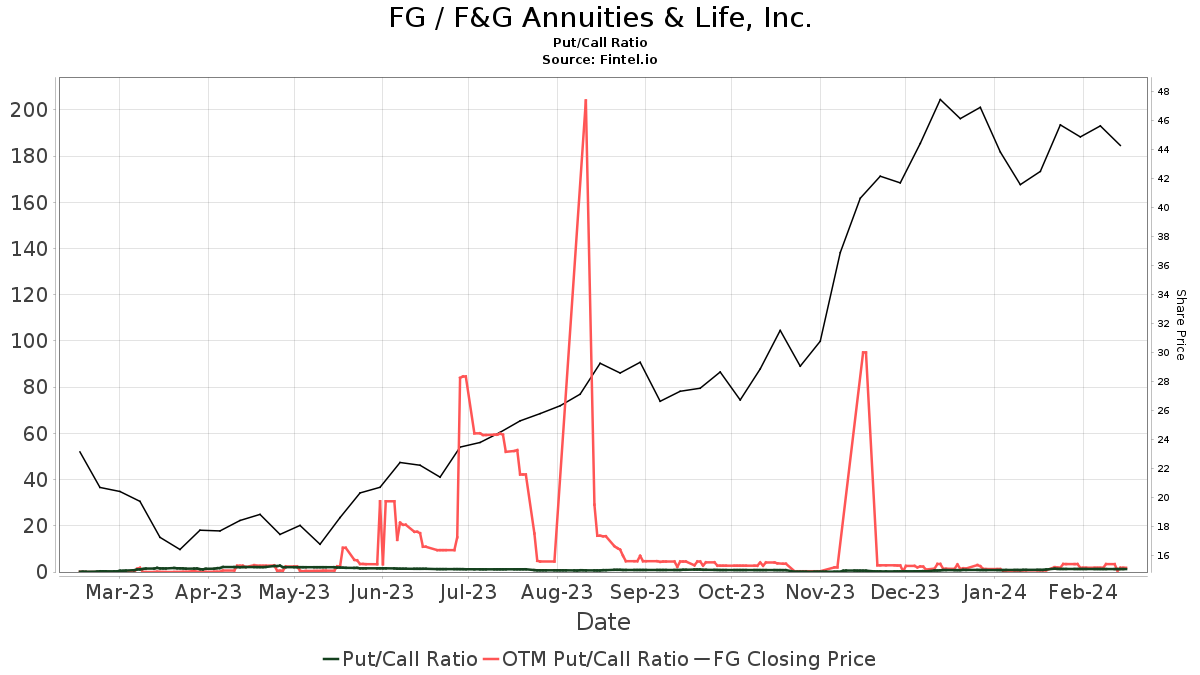

Additionally, the put/call ratio of FG is 1.27, suggesting a bearish outlook.

Analyst price forecasts have indicated an average one-year price target for F&G Annuities & Life of 48.45. This represents an 8.71% increase from the latest reported closing price of 44.57.

The projected annual revenue for F&G Annuities & Life is expected to be 5,261MM, marking a significant 47.82% increase. Furthermore, the projected annual non-GAAP EPS is 4.41.

Institutional Holdings

Fidelity National Financial owns 106,443K shares, representing 84.82% ownership of the company, with no change in the last quarter. Meanwhile, Brave Warrior Advisors holds 6,217K shares, representing 4.95% ownership, reflecting a 7.61% decrease in its prior filing. On the other hand, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares and IWM – iShares Russell 2000 ETF have also made adjustments to their portfolio allocation in FG.

Geode Capital Management has increased its portfolio allocation in FG by 50.45% over the last quarter, holding 379K shares representing 0.30% ownership of the company. Their proactive approach signifies a bullish sentiment regarding F&G Annuities & Life.

Company Background

Established in 2016, FGL Holdings focuses on assisting middle-income Americans in preparing for retirement and achieving financial security. It offers fixed annuities as well as life insurance products, with a commitment to protecting principal and delivering predictable income streams.

The company’s headquarters are located in George Town, Cayman Islands, reflecting its global reach and strategic positioning.

We provide the most comprehensive investment research available to individual investors, traders, financial advisors, and small hedge funds. Our inclusive data range covers fundamentals, analyst reports, ownership data, fund sentiment, options flow, insider trading, and more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits. Click to Learn More and enhance your investment strategy with our powerful tools.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.