Fidelity National Information Services, Inc. FIS recently announced the launch of FIS Digital One Flex Mobile 6.0, an upgraded version of its mobile banking application for its financial institution customers. This move is aimed at catering to the growing demand for mobile banking services for customer interactions with the bank.

Per American Bankers Association, almost 50% of users in the United States use mobile applications for banking. Gen Z and Millennial customers are at the forefront of driving this transformation. Given the rising demand, it becomes important for financial institutions to provide an intuitive and seamless experience through their banking applications. The new product from FIS offers a user-centric design and improved functionality catering to user preferences. Improved customer satisfaction bodes well for the company.

This move bodes well for FIS as offering cutting-edge digital solutions should help with retention and attract new clients. As the company gains new customers, it will benefit from improved revenues in the form of licensing agreements, subscription fees and other service offerings. The latest product also emphasizes on fraud prevention, enabling financial institutions to bypass cybersecurity threats. This will also prevent financial institutions from costly breaches of cybersecurity and help them protect their customers’ data.

Digital One Flex Mobile 6.0 is an all-in-one platform providing digital banking services through mobile and online, improving management efficiency and customer support. Biometrics, user ID and password reset have been added to improve ease of use and security. Bill payment, Zelle, internal and external transfers and loan payment capabilities are enhanced in this product. Other features such as running balance, display of routing and account numbers also bode well.

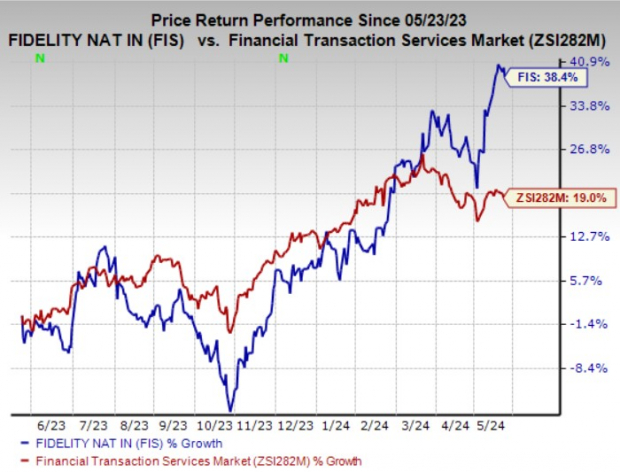

Price Performance

Shares of Fidelity have gained 38.4% in the past year compared with the 19% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Fidelity currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Business Services space are MoneyLion Inc. ML, Global Payments Inc. GPN, and WEX Inc. WEX. MoneyLion sports a Zacks Rank #1 (Strong Buy), while Global Payments and WEX carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MoneyLion’s current-year bottom line indicates a 131.3% year-over-year improvement. The consensus estimate for ML’s current-year top line is pegged at $524.8 million, suggesting 23.9% year-over-year growth.

The Zacks Consensus Estimate for Global Payments’ 2024 earnings is currently pegged at $11.63 per share, indicating 11.6% year-over-year growth. It beat estimates in each of the past four quarters with an average surprise of 1.1%. The consensus mark for GPN’s revenues of $9.2 billion suggests a 6.4% increase from the year-ago level.

The Zacks Consensus Estimate for WEX’s 2024 earnings of $16.26 per share indicates 9.8% year-over-year growth. It beat earnings estimates thrice in the past four quarters and missed once, with an average surprise of 3.3%. The consensus estimate for WEX’s current-year revenues is pegged at $2.7 billion, a 7.6% increase from a year ago.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

WEX Inc. (WEX) : Free Stock Analysis Report

MoneyLion Inc. (ML) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.