“`html

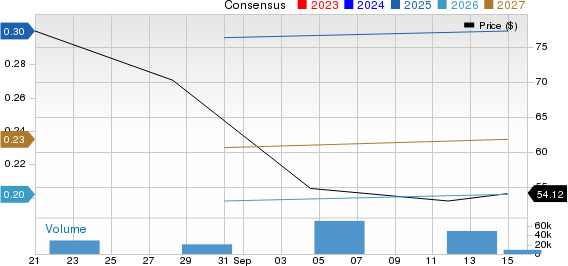

Figma (FIG) shares have fallen 29.3% in the past month, significantly underperforming the Zacks Computer and Technology sector’s gain of 4.5% and the Zacks Internet Software industry’s 0.7% increase. The company’s third-quarter 2025 revenue guidance forecasts $263 million to $265 million, indicating a year-over-year growth of 33% at the midpoint, down from 41% in Q2 2025. The Zacks Consensus Estimate for Q3 2025 revenues stands at $263.9 million, with earnings expected at 4 cents per share.

For the full year of 2025, Figma anticipates revenues between $1.021 billion and $1.025 billion, suggesting 37% year-over-year growth. Operating income is projected to range from $88 million to $98 million, aligning with the Zacks Consensus Estimate of $1.02 billion in revenues and earnings of 30 cents per share. The company faces stiff competition from Adobe, Microsoft, and Atlassian, while its AI initiatives remain in their early stages.

Figma’s innovative portfolio launched four new products at its annual Config conference, including Figma Make, aiming to enhance productivity for designers and developers. As of June 30, 2025, Figma had 11,906 paid customers with over $10,000 in annual recurring revenues and 1,119 customers with over $100,000 in annual recurring revenues. However, the company’s valuation, trading at a forward price/sales ratio of 18.81X, raises concerns among investors.

“`