The Nasdaq and the S&P 500 are trading near all-time highs as Wall Street begins one of the last major weeks of Q1 earnings season. Nvidia surged to start the week ahead of the AI chip superstar’s earnings release on Wednesday.

Outside of NVDA, Wall Street will pay close attention to reports from Target, TJX, Ross Stores, Dollar Tree, and a handful of others to gauge how consumers are holding up amid lingering inflation. The market will also dig into the Fed’s May FOMC minutes on Wednesday afternoon.

NVDA and the AI hype might move the market later this week. But volumes are already hitting summer levels heading into Memorial Day. On top of that, traders are starting to call for a slow grind higher over the summer. This is a good sign because most bears avoid trying to ‘short a dull market.’

On top of that, one of Wall Street’s most famous bears, Morgan Stanley’s Mike Wilson, recently raised his S&P 500 price target from 4,500 to 5,400. The bulls are back in control heading into the summer and investors likely want to keep adding exposure to close out May.

That said, some stocks are looking a little overheated. Thankfully, there are tons of top-ranked value stocks to buy, especially if you know where to look.

Today we demonstrate how investors screen for stocks that offer the potentially winning combination of impressive value and improving earnings outlooks to consider buying heading into June.

Screen Basics

The screen we are digging into today comes loaded with the Research Wizard and aims to sort through highly-ranked Zacks stocks to find some of the top value names.

This value-focused screen searches only for stocks that boast Zacks Rank #1 (Strong Buys) or #2 (Buys). It also focuses on stocks with price-to-earnings (P/E) ratios under the median for its industry. The screen also looks for stocks with price-to-sales (P/S) ratios under the median for its industry to help lock in relative value compared to its peers, since basing it off the wider market is not always the most useful tool.

The screen then digs into quarterly earnings rates above the median for its industry. This particular Zacks screen also uses a special blend of upgrades and estimates revisions to select the best seven stocks in this list.

The screen basics are listed below…

· Only Zacks Rank #1 (Strong Buy) or #2 (Buy) Stocks

· P/E (using 12-month EPS) – Under the Median for its Industry

· P/S – Under the Median for its Industry

· Percentage Change Act. EPS Q(0)/Q(-1)

· Rating Change and Revisions Factors (to help narrow the list to the 7 best stocks in this list)

This strategy comes loaded with the Research Wizard and it is called bt_sow_value_method1. It can be found in the SoW (Screen of the Week) folder.

The screen is pretty simple, yet powerful. Here is one of the seven stocks that made it through this week’s screen…

M/I Homes (MHO)

M/I Homes is a home builder focused on single family homes, serving a range of buyers from first-time and move-up to luxury and empty nesters. MHO went on a booming run over the last decade, posting double-digit revenue expansion for nearly 10 straight years before slipping slightly in 2023 against an impossible-to-compete-against stretch.

Image Source: Zacks Investment Research

The housing market is turning around and M/I Homes posted strong first quarter 2024 results, with new contracts up 17% to 2,547. M/I Homes grew its revenue by 5% and boosted home deliveries by 8% to 2,158. Interest rates have likely peaked and buyers are starting to come back. MHO’s cancellation rate was 8% in the first quarter vs. 13% in the year-ago period.

M/I Home crushed our Q1 EPS estimate and boosted its guidance, helping it earn a Zacks Rank #1 (Strong Buy) right now. The company is projected to grow its revenue by over 5% in 2024 and 2025 to reach $4.49 billion. The long-term outlook for M/I Home and the entire homebuilder industry remains impressive since Millennials are driving the housing market and Baby Boomers are finally retiring and moving. Plus, home builders didn’t overbuild during the covid boom.

Image Source: Zacks Investment Research

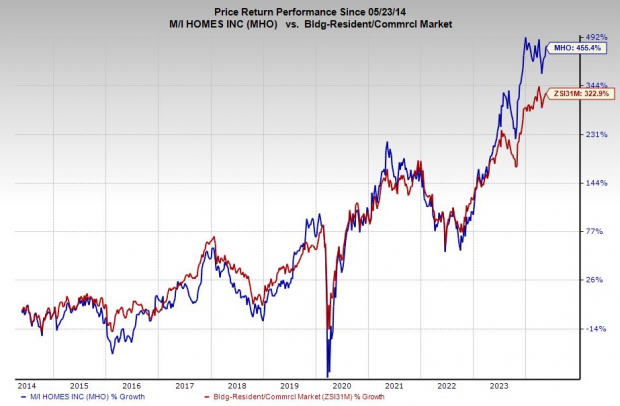

MHO shares have soared 455% in the last 10 years to more than double the S&P 500 and blow away its highly ranked Building Products – Home Builders industry’s 322%, including an 85% surge during the past 12 months. M/I Home’s outperformance makes its valuation far more impressive. The stock trades at a 49% discount to its 10-year highs and right at its median. MHO also trades at a 30% discount to its industry.

Get the rest of the stocks on this list and start looking for the newest companies that fit these criteria. It’s easy to do. And it could help you find your next big winner. Start screening for these companies today with a free trial to the Research Wizard. You can do it.

Click here to sign up for a free trial to the Research Wizard today.

Want more articles from this author? Scroll up to the top of this article and click the FOLLOW AUTHOR button to get an email each time a new article is published.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: www.zacks.com/performance_disclosure

Today’s Stocks from Zacks’ Best Screens

Starting today, you can get instant access to the latest picks from our time-proven screens which since 2000 have soared far above the market. While the S&P 500 averaged +7.0% per year, we saw results like these: Small-Cap Growth +44.9%, Filtered Zacks Rank5 +48.4%, and Big Money Zacks +55.2%.

You’re invited to screen the latest stocks in seconds by trying Zacks’ Research Wizard stock-picking program. Or use the Wizard to create your own market-beating strategies. No credit card needed, no cost or obligation.

M/I Homes, Inc. (MHO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.